Towers Watson analysed the MySuper product default insurance arrangements for 37 of the largest public offer superannuation funds in Australia and found a wide range of structures available in the market – and an even wider range of default insurance costs.

Fund members have growing awareness of the insurance they hold within superannuation.

That poses some very big questions for trustees – how do they deliver an appropriate and competitive default insurance structure, how can they contain costs and how can they use insurance as a point of differentiation in the market?

What’s driving default insurance?

For decades, default insurance has provided affordable, accessible insurance cover to the majority of employed Australians.

MySuper and Stronger Super have heightened the focus on default superannuation, increasing the governance level required.

APRA Prudential Standard SPG250 requires that all trustees (not just MySuper product holders) have an appropriate Insurance Management Framework, recognising the demographics of their membership, and a detailed consideration of other insurance issues.

But what does that mean for funds at a time when the Australian group insurance market is going through substantial change?

Generous automatic acceptance provisions in group insurance have made it cheap and easy for trustees to provide coverage to a broad spectrum of members, but now insurance costs are rising sharply in many funds and that brings an affordability issue into play.

Is the role of default insurance to fully insure members to an adequate level or should it be a safety net, supplemented by the ability to build higher levels of cover to meet personal needs at an affordable cost?

What balance does the trustee set between the competing goals of providing (and charging for) appropriate insurance, and the main goal of saving for retirement?

What does MySuper default insurance look like ?

Default insurance design offers the greatest flexibility to trustees who want to differentiate their MySuper product in the market or to tailor the insurance to their membership base.

MySuper products are required to include default death and TPD cover, set at a level appropriate to the demographics of the membership.

Salary Continuance Insurance (SCI) is not compulsory, but an increasingly topical issue is whether long-term SCI is actually a more appropriate and manageable benefit than TPD for the majority of members.

Our analysis showed that 38 per cent of the MySuper products researched now include default SCI for up to two years, and a further 11 per cent include longer term default SCI.

How insurance costs are split among a fund’s members is a crucial design question.

It’s a balance between simplicity of design and equity between members. Where different groups of members have clearly different risk profiles, to what extent should these differences be reflected in insurance costs?

Our analysis showed 49 per cent of the MySuper products researched differentiate default insurance costs by occupation, but only 16 per cent by gender. The membership profile of the fund clearly influences this decision; the more homogenous the membership, the less need to vary insurance costs by gender or by occupation.

When are default insurance costs too high?

Insurance costs are rising rapidly for some funds and typical insurance premium deductions are now much more significant than the $1 per week seen in the past. Indeed, only one fund researched had costs of $1 per week or less.

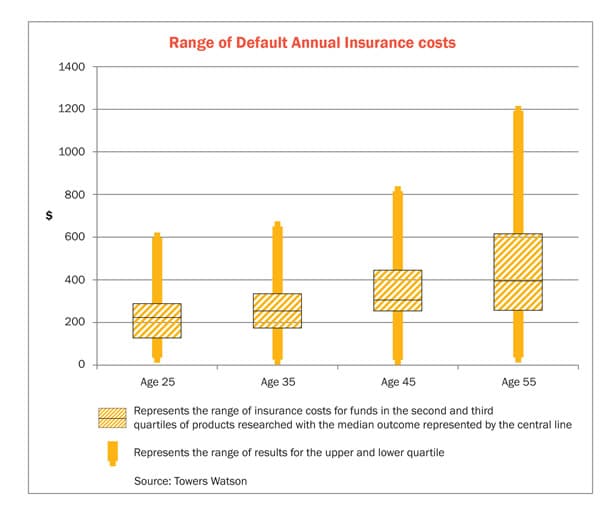

There is a wide range in the member cost of default insurance in the MySuper products researched. The chart below shows this range including death, TPD and, where applicable, SCI costs.

Not surprisingly, the funds offering default SCI as well as death and TPD cover tend to have higher costs, in line with their more comprehensive insurance arrangements.

These costs are extracted from the insurance fees contained in current PDS documents. However two major funds researched announced significant increases to their insurance costs which came into effect on July 1.

There is still clearly the prospect that other funds will announce significant increases before insurance costs might stabilise.

Section 52(7) of the SIS Act requires the trustee to ensure that default insurance does not “…inappropriately erode the retirement income of members”. But what does this mean?

The research shows a median default insurance cost for a 35-year-old is around $255 a year.

To put that into perspective, let’s use an example for an employee earning $60,000 (roughly a median wage); the 9.5 per cent SG contribution is $5,700 before 15 per cent contributions tax and APRA quotes the average superannuation balance in industry funds at $28,172*.

Thus, the median insurance cost represents 4.5 per cent of this employee’s annual SG contributions or 0.91 per cent per annum of the average industry fund account balance.

Are these costs at a level that erodes the retirement income of members? The answer is probably “no” at these levels.

However, when seven of the funds researched have default insurance costs for a 35-year-old member currently over $400 per year and in a climate where insurance costs are continuing to increase, the potential for an affordability issue becomes real, particularly for part-time employees.

A well-considered default insurance strategy is now not only a prudential requirement, but a commercial necessity as funds grapple with how to differentiate their product offering within the market and deal with a very difficult environment of rising group insurance costs and more restrictive terms and conditions.

The days of the ‘underinsurance problem’ driving design on the premise that more default cover and higher automatic acceptance is always better now need to be questioned.

Design needs to be considered in the context of what might better suit the needs of members and not materially erode their potential retirement incomes. This requires careful thought about who a fund’s default members are and what is really in their best interests.

As with other aspects of superannuation fund design, understanding the membership and their particular demographics, employment patterns and level of engagement is the starting point for any good design.

* Source: APRA Superannuation Annual Bulletin June 2013 (revised 5 Feb 2014)

Consulting actuary Phil Patterson leads Towers Watson’s group insurance thought leadership and product research team and is a current member of ASFA’s Insurance Standing Advisory Panel. He has 25 years’ experience in superannuation and employee benefits in both life office and consulting roles. He is based in Sydney.