As interest rates have fallen globally investors have engaged in an unprecedented search for income.

Global bond yields are at historic lows, with interest rates now negative in some countries. In Australia, the Reserve Bank of Australia’s cash rate, after the May cut, is now at two per cent.

In this environment, it is easy to see why many investors are looking to equities for income.

In Australia, one of the best sources of income in the ASX200 has been bank shares.

In many portfolios, this has led to a concentration in banking shares. We believe this may be a concern, especially given their current high valuations and exposure to the residential property market.

The good news is that there are other ways to get income in the equity market, but you need to wary of the risks.

The income should be sustainable and you have to be mindful of the capital component of your total return.

The capital component is why valuation is important when assessing income stocks. You have to be wary of paying too much for the shares that are generating the income.

For example, there is simply no point paying $100 for a stock to get $5 of income if the value of that stock falls to $90. Your total return is ultimately negative in that situation.

As retirees are particularly sensitive to a drop in the value of their lump sum, they can ill-afford big falls in asset prices.

While the market has historically been a great place to be for the long run, there can be substantial periods where you can incur a capital loss if your timing is unfortunate.

If you are in, or near, the pension phase, this may not be tolerable.

While an active manager can help by avoiding the riskiest parts of the market, the simple fact is, if valuations are stretched and begin to reverse, if you are fully invested, you are at risk of incurring potential capital losses.

There are a number of funds, including ours, which retain the ability to move some of the portfolio to cash, if there is no value in the market. However, currently, we are still finding enough companies that we believe can deliver both yield and capital growth into the future.

Funds should have a clear focus on valuation and an ability to move to cash, as many equity income funds are proving to be highly volatile.

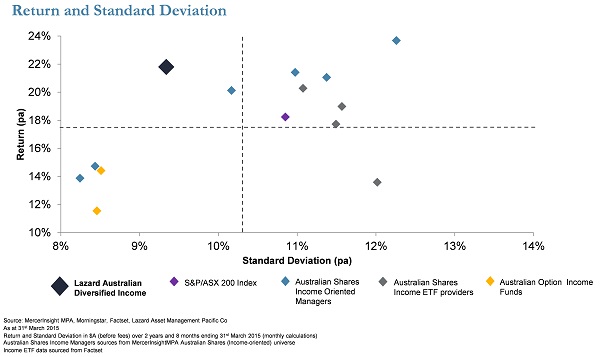

More than half of the equity yield universe (including both exchange-traded funds (ETFs) and actively managed funds) have a higher standard deviation than the market. In many cases, they are looking for yield by increasing the risk exposure.

The chart shows the risk/return of the equity income universe, since we have been managing the Lazard Australian Diversified Income Fund. As you can see many have much higher standard deviation, or in the case of option income funds lower returns, than the index.

It also should be remembered that we have been through a fairly benign environment over the last five years.

Investors may want to consider how their income strategy will behave should we enter a more difficult period.

The top holdings of ETFs and many income funds are often the biggest banks, so in the event that the banks do run into trouble from their property exposure, the likelihood of large drawdowns is higher.

A more diversified fund helps to reduce the likelihood of investors being exposed to a major correction in any one particular segment of the market.

Equities can be a great way to achieve the level of income many retirees need to fund their retirement, however, investors should be cautious that in achieving a targeted yield they should not forget the importance of capital return.

Phil Hofflin is a portfolio manager at Lazard Asset Management.