The index also has a tendency to push the valuations of an entire industry to incredibly high and unsustainable levels.

We think history shows that these positions typically do reverse over time and when they do the benchmark can have an increased risk of poor performance.

One of the perennial problems of the ASX200 Index is that a small number of stocks dominate it.

The level of concentration in the top few stocks is quite unique by international standards.

For example, in the US, the largest stock in the S&P500 is Apple, which is just under four per cent of the index, and there is only one other stock (Microsoft) that is more than two per cent of the index.

In Australia, the largest stock is closer to 10 per cent and the top five names in the ASX200 currently make up more than 35 per cent of the index. The top 10 stocks make up almost half of the index.

This level of concentration in a small number of securities can make diversification difficult, particularly if the larger names are all from one or two sectors.

The dominance of certain sectors is another problem with the index.

Financial stocks (excluding property) now make up around 40 per cent of the ASX 200.

That is a high percentage of the Australian equity market in financials when compared historically to the index and other international markets.

Interestingly, this kind of sector distortion is not uncommon in the ASX200.

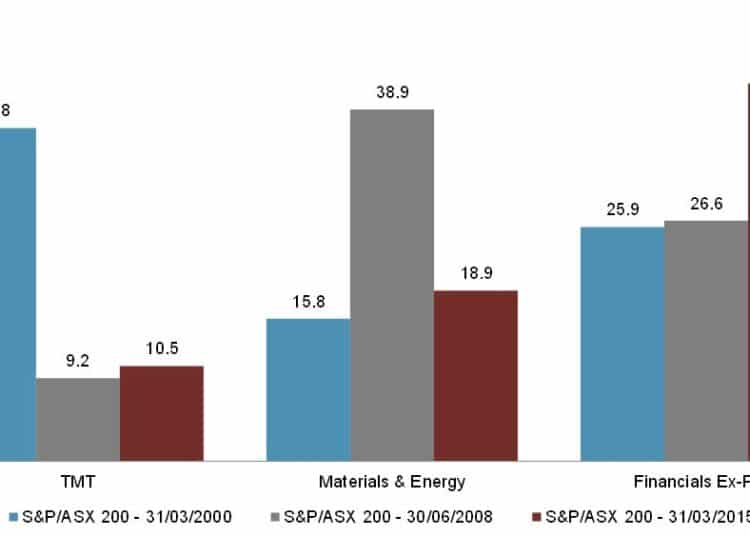

In 2000, in the middle of the tech boom, technology, media and telecommunications (TMT) stocks made up nearly 37 per cent of the ASX200. By 2008, the weighting had dropped to just over nine per cent.

The next sector event occurred in the materials and energy sectors. In 2008, materials and energy stocks made up nearly 39 per cent of the ASX200, today they make up just under 19 per cent of the index (see below).

Sector concentrations in the S&P/ASX200

Unsurprisingly, the index performed relatively poorly as these sector positions unravelled. In the three years after the peak of the tech boom, the index returned just four per cent annualised.

Similarly, in the five years post the end of the resources boom in 2008, the index returned just under five per cent annualised.

These two experiences further confirmed our view you need a diversified portfolio that is different from the index.

Many Australian equity managers are closely linked to the benchmark.

Looking at Mercer data of the Australian equity managers’ universe, as at 31 March 2015 the median tracking error over the last three years is just 2.5 per cent.

In our opinion, during an environment like this, this low tracking error may not be sufficient to diversify away from the benchmark risk we are seeing.

We believe a truly active manager should provide returns that are not closely correlated to the ASX200.

Many people incorrectly believe that a higher tracking error means higher risk, however in our view this is not always the case.

The benchmark can, during certain environments, show higher absolute volatility than active managers and in our opinion this is a better measure of the risk in the portfolio.

In essence, at times during these sector distortions we would argue the index itself is naively diversified.

One way to reduce volatility in a portfolio is for the portfolio to be diversified.

We believe it is important to think of portfolio diversification along economic sectors.

That is diversify stock holdings across short cycle (technology, media and telecommunications), long cycle (basic materials, resources and industrials), interest-rate sensitive (banks, insurers and utilities) and consumer related (both staples and discretionary).

Portfolio positioning with an eye to economic diversification can prove an effective tool to manage economic variability risk.

We do think the Australian market has companies that look to be attractive long-term investments on a valuation basis.

Our funds are invested in telecommunications, media, utility, resources, industrials, consumer and even some financials that we believe have upside potential.

However, in our view, we believe a diversified valuation driven portfolio is a safer approach to accessing the Australian marketplace in the current environment, as opposed to one that is closely tracking the ASX200.

Rob Osborn is an Australian Equities portfolio manager at Lazard Asset Management.