In our research we have challenged the perception that passive investing is an inherently tax efficient way for superannuation funds to invest.

Parametric has identified 10 features of a genuine after-tax focused passive equities strategy that are lacking in typical passive equity strategies, broadly grouped into areas of lost opportunity to improve returns.

We also looked at areas which prevent the strategy being measured and assessed in transparent after-tax returns – what super fund members actually care about.

These are not just conceptual differences, but can potentially cost a super fund in real foregone returns – 25-30 basis points each year for passive Australian equities and 45 basis points each year for passive global equity portfolios.

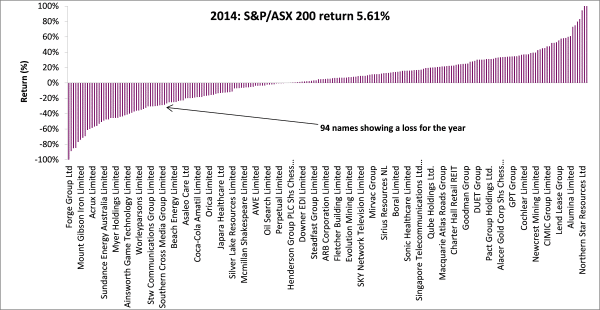

We can illustrate one way in which a typical tax-naïve passive Australian equities strategy leaves valuable basis points on the table by decomposing the returns of the ASX for the 2014 calendar year.

This is shown below:

Source: S&P, Parametric (2015)

Super funds may well be familiar with the pre-tax return of the index last year – about 5.61 per cent pre-tax.

They may be less familiar with the security-level contributions to this return and, in particular, may not know that 129 stocks in the ASX 200 returned a gain (or were flat) and the remaining 94 returned a loss.

The presence of a significant proportion of loss stocks is not unique to 2014 or to similar low-return years: the previous year (2013) delivered an overall return of 20.2 per cent, but within this, 87 stocks returned a loss rather than a gain.

This highlights one – just one – advantage of a genuine after-tax focused passive equities strategy over a typical tax-naïve passive approach.

A tax-naïve approach relies simply on “keeping turnover low” – not realising taxable gains on securities or, if they are realised, realising the gains at the concessional capital gains tax discount rate because the securities have been held over 12 months.

In 2014, this natural tax efficiency benefited at best 57.85 per cent of the portfolio universe – the 129 gain stocks – and ignored the remaining 42.15 per cent.

The problem is that there is tax value that can be unlocked in some of the remaining 42.15 per cent: these stocks are held at a loss but cannot be used to shield other taxable gains in the fund’s portfolio (not just in equities) until they are realised.

A much better tax-efficient investment approach is one which unlocks the value of these losses through trading so the fund can bank the tax loss shelter attached.

Provided the trading is not initiated for tax reasons, this is a permissible – and significant – part of an after-tax strategy’s ‘opportunity set’ which is ignored by typical passive strategies.

This creates a clear choice for superannuation funds who invest into equities passively and who genuinely care about delivering after-tax returns to members.

One option is to stick with an old-style passive approach which ignores, in 2014 terms, 42.15 per cent of the opportunity set to improve returns and relies on a simplistic ‘keep turnover low’ message.

A better option is to adopt what arguably is the natural evolution of passive investing in an era where fiduciary alignment between trustees and members is paramount and after-tax returns are replacing pre-tax returns as the focus of return objectives.

The next-generation of passive equity approaches will be hard-wired to exploit the full 100 per cent set of opportunities available to maximise confidence in meeting return objectives – just as we expect, and just what trustees and CIOs need from any good investment strategy.

Raewyn Williams is the director of research and after-tax solutions at Parametric.