We all know the traditional small-cap story. Speculative and short term in nature, an investor’s allocation is often underpinned by a view that the economic landscape going forward is strong and smalls potentially offer higher levels of capital growth.

Predominately higher risk than large-cap stocks, the role of small-caps in a portfolio is generally to add spice when an investor is seeking growth potential during times of exuberance.

Flows to smalls therefore have been quite cyclical, to the detriment of investor returns.

However, this does not need to be the case, as small-cap companies are not all inherently trends-based, and thus temporary, growth stories.

Despite the subdued economic outlook, now is the time to consider an allocation to quality and prudently managed small-cap companies in order to source growth and income from a broader opportunity set.

Buying high, selling low: an unfortunate trend

In my time there have been a number of periods when “high growth” appeared to be available in abundance and relatively easy to achieve.

To the untrained eye markets were going to the moon in 2005 (+20 per cent), 2006 (+34 per cent) and in 2007 (+17 per cent), luring many investors right at its peaks.

However, this was a time for caution for IML, which proved to be a prudent approach as the small-cap sector subsequently corrected by more than half the following year.

This chase for excess growth, fundamentally a short-term play, has often made small-cap investing a strategy dependent upon timing the market and knowing when to get in and out.

This is an inherently difficult strategy to implement for any investor. When we look across the industry we have observed that investors in small-caps have primarily chased lucrative capital gains, getting in at the top when momentum is high, selling down their allocations during periods of volatility or slowing economic growth.

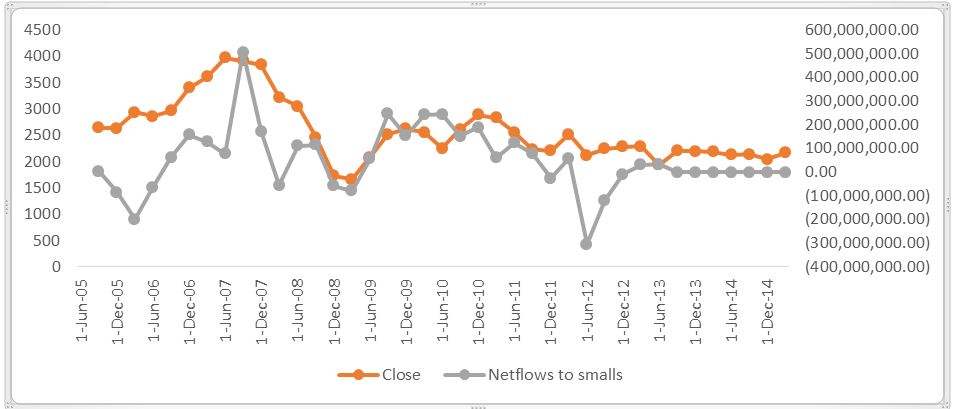

The chart below shows this relationship between net flows to small-cap funds (grey line) and the ASX Small Ordinaries Index (orange line) over the last 10 years.

Source: Morningstar Asset flows, calculated using a subset of Morningstar smalls peer group, calculated 10 years to March 2015

As shown in the chart, net flows in to small-cap funds peaked right at the high point of the index in 2007.

Outflows also followed the index and reached a low point right alongside the index bottom in 2008-2009; an unfortunate demonstration of investors buying high and selling low.

In light of this trend, and the current subdued economic outlook, it’s not surprising that the appetite for small-caps is quite modest at the moment.

The past 12 months have generally been tough for Australian and global investors.

With widespread volatility and weakness in commodity prices, such as iron ore, copper and oil, earnings downgrades have spread from the resource sector into the wider Australian economy.

Sluggish credit growth and increasing capital requirements have added to the mix, creating headwinds for the banking sector and wider Australian industries.

Looking ahead, a disappointing reporting season has done little to help local investor confidence, with many companies reporting little in the way of top-line growth and muted guidance for 2015-16.

The trend of weakness across a broad range of sectors and stocks looks set to continue, adding to investor uncertainty and movement away from the mid and small-cap market.

Quality rather than size is key to risk

Counteracting this traditional approach, we believe now is the time to consider a quality allocation to small- and mid-caps.

The fact that the largest individual stock of the mid-cap index represents less than 3.5 per cent is testament to the variety of opportunities in this part of the market – a portfolio of smaller-cap stocks does not have to be a high risk strategy for investors.

A key learning from my time in the industry has been that the strength of a company’s management is not dependent on the size of its market cap.

When companies are filtered for quality and earnings growth derived outside the economic cycle, many mid and small-cap stocks display the virtues we look for in all companies when investing.

These companies typically have a competitive advantage and recurring and predictable earnings.

Their capable management is generally able to deliver earnings growth despite the subdued economic environment, through initiatives such as cost outs, acquisitions, contracted growth, market share gains and other restructuring plans.

A good example of such a company for us was Energy Developments (ENE). We were long-term investors in ENE, attracted to its competitive advantages in renewable energy production and its highly contracted revenue streams.

These attributes produced recurring earnings and strong free cashflow, which Duet Group (DUE) recognised would complement its existing utility businesses when a takeover was announced in August.

We have been cautiously positioned across our funds for some time, benefitting from underweight exposures to the resources and mining services sectors.

Other quality companies such as Amalgamated Holdings, Mayne Pharma and Skycity have also contributed positively to returns over the last three years.

Simon Conn is a senior portfolio manager at Investors Mutual Limited (IML).