It is projected that by 2032 there will be 5.8 million Australians over the age of 65 and the pool of post retirement assets will be more than $1.3 trillion.

As these people move into retirement, their investment needs will change, with an increased emphasis on income, lower absolute volatility and inflation protection.

Equity income is one of the many investment options that is being suggested as a logical investment for retirees. With interest rates currently so low, it is easy to see why.

We believe an equity income fund should deliver higher yield than term deposits and also offer the capital growth potential that equities can provide.

Many investors also believe that equity income funds are less volatile than the broader equity market as they view dividend paying companies as being more stable.

The recent market correction in Australian equities offers an opportunity to assess the defensive qualities of income funds under the stress of a falling market.

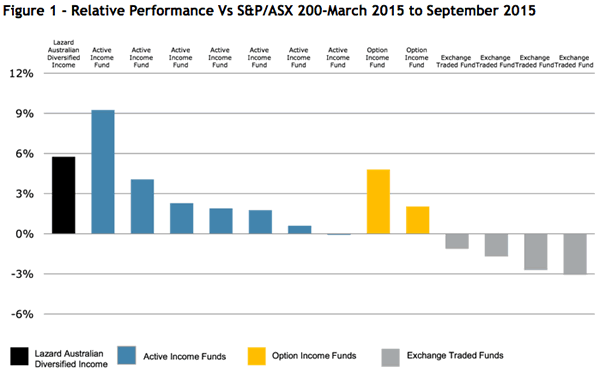

During the period of March 2015 to September 2015, when the index was down 12.75 per cent, we observed a significant divergence in returns depending on the structure of the equity income fund.

We think that you can break the equity income market into four main buckets: yield exchange-traded funds (ETFs) that passively select the highest-yielding stocks; hybrid equity and option strategies; active strategies that are fully invested in equities; and active equities that are also able to allocate to cash on a strategic basis.

During this six-month period we also observed that high-yielding ETFs struggled the most.

As the relative return chart below shows, rather than defend in the period, most high-yield ETFs (columns shaded in grey on the chart) actually fell more than the index.

Universe selected from MercerInsightMPA Australian Shares (income-oriented) universe. Chart shows the Lazard Australian Diversified Income Fund and peers during months of negative performance of the S&P/ASX 200 from March 2015 to September 2015. Past performance may not be indicative of future results. All fund providers data sourced from Factset. Source: Lazard Asset Management Pacific Co., FactSet, ASX

The chart demonstrates that active equity income strategies fared much better during this period and on average outperformed the index during the downturn.

There was quite a wide divergence between different funds (see those shaded in blue), but as a group they performed much better than ETFs.

Option income funds also defended better than the index (see columns shaded in yellow), however, they have not defended as well as active funds and their overall volatility (as measured by standard deviation) has been relatively high.

The Lazard Australian Diversified Income Fund fits within a fourth category, active equity with the ability to go to cash, if opportunities are limited.

This proved to be one of the better approaches during the recent downturn (the black column in the chart).

We believe this is due to an investment philosophy of not overpaying for yield and investing in companies that we consider have the potential for capital growth.

In practice, this meant leading into the downturn we had an allocation to term deposits where we felt the quality of income opportunities from shares was limited and invested in some stocks that were perhaps not the highest yielding, but that we believed had lower risk of capital loss.

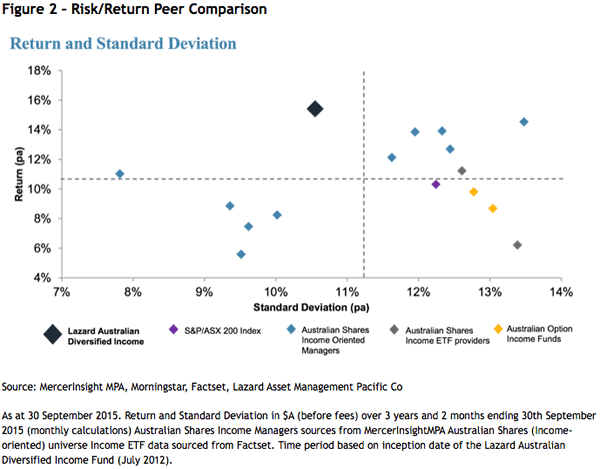

During this period we were still able to generate a current yield of above six per cent since the inception of the fund and deliver a relatively strong risk/return profile in comparison with peers (see Figure 2).

We think this market correction has highlighted a flaw in the approach of exclusively chasing yield at the expense of a focus on total return.

For an investor entering the pension phase drawdowns can prove very costly.

Retirees are particularly sensitive to a drop in the value of their lump sum, and they can ill-afford big falls in asset prices.

A sole focus on yield when investing in the Australian equity market can lead to increased risk in a portfolio, as investors can move further out on the risk spectrum to reach income targets.

In our view, investors should remain vigilant when seeking income and keep in mind the trade-offs between risk, return and volatility.

With an uncertain economic outlook, we do believe those entering the pension phase need to look very carefully at a fund’s ability to target a total return in a variety of market environments.

We believe a diversified equity income strategy that emphasises sustainability of dividend and ability to move to cash is an attractive option for investors nearing retirement.

Aaron Binsted is a portfolio manager and analyst with Lazard Asset Management's Australia Equity Team.