In our view, there is evidence that they can – if investors use the right strategies.

The notion that bonds can still have an important role to play in portfolios may surprise many investors – particularly those focused on home-country markets.

It’s no secret, however: looking beyond the front door to global bond markets can help investors improve their risk-adjusted returns (see table below). A little recent history helps to explain this.

Investors are cautious

Before the global financial crisis, the role of bonds in diversified portfolios was understood to be fairly straightforward: they contributed to the portfolio’s overall income flows and provided a measure of stability against the ups and downs of the equities market.

Their defensiveness was linked to interest rates. When, for example, an economy was heading for a slowdown, equities would typically fall on the expectation that company profits would, too.

But a slowdown meant that interest rates were likely to be cut – a positive for bonds which, because they pay yields above the cash rate, would then become even more valuable to income investors.

This low correlation between bonds and equities largely explained the diversification benefits of mixing bonds and equities in a portfolio.

Since the crisis, however, the picture has changed. Interest rates are at historic lows and central-bank buying of government bonds has forced yields to record lows (because yields move inversely to bond prices).

Understandably, investors are wary of holding bonds now and for the foreseeable future: they see bonds as expensive and likely to lose value, once yields and interest rates start to normalise.

There are bonds … and there are bonds.

The key point to understand, however, is that not all bonds are created equal. Although the bonds referred to in media headlines are usually government securities, bond markets are actually quite diverse.

In addition to government bonds, they include corporate bonds or credit and other, more specialised, securities (such as mortgage-backed bonds).

This diversity becomes even greater when global bond markets are taken into account. Global government bonds include those issued by sovereign borrowers in most if not all developed economies and many emerging economies, too. This typically results in a greater opportunity to reduce risk and improve returns.

The reason is that, at any given time, many countries tend to be at different stages of their respective business cycles, meaning that their interest-rate cycles will be at different stages, too.

This divergence is particularly accentuated in the current global economic environment, a fact that helps explain much of the continuing volatility in financial markets.

For example, although the Fed is raising rates in the US, Japan is still in the middle of a quantitative-easing program (indeed, the Bank of Japan recently became even more accommodative by introducing a negative interest-rate policy) and we expect Europe to expand its quantitative-easing program in March.

In other words, even if interest rates in one country keep rising, those in other developed markets may fall – and create actionable opportunities for bond investors.

The same may be true for emerging-market bonds, whose yields have risen recently to the point where some reversion to more normal levels might be expected.

Research is important

Corporate bonds provide further diversification within a fixed-income allocation because, compared to government bonds, their valuations tend to be driven less by changes in interest rates and more by perceptions of their creditworthiness, or the bond issuer’s ability to repay the debt in full on maturity.

Another reason they’re attractive is that they typically pay higher yields than government bonds, because they’re riskier.

The difference in yields, known as the “spread”, has widened during the last few years as government yields have fallen relative to corporate yields, making corporate bonds even more attractive compared to government securities.

Unfortunately, this has resulted in many investors buying “high-yield” bonds – corporate securities with lower-than-average credit ratings – without, in our view, due consideration of the risks involved.

In the corporate and high-yield markets, as in the government bond markets, strong research and active portfolio management are vital to successful investment outcomes.

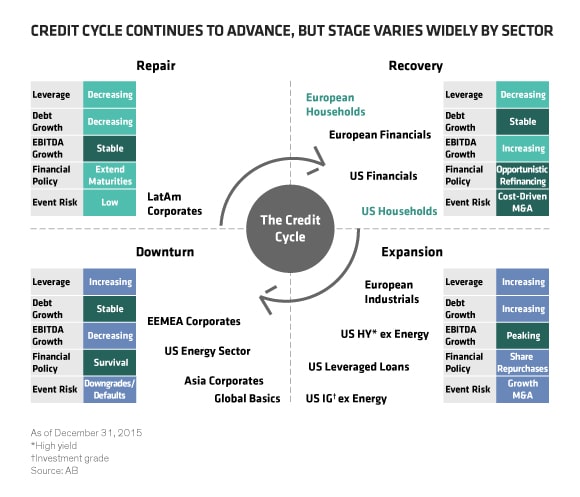

Based on our own research, we don’t share the view that recent sell-offs in credit markets herald a re-run of the rout in the sector that occurred during 2008. We regard the risks as cyclical rather than systemic, and a natural outcome of the fact that the credit cycle affects different geographies and industrial sectors differently over time (see below).

The advantages of investing in bonds globally and across sectors can (and, we believe, should) be enhanced by currency hedging, with the aim of smoothing out the effects of exchange-rate fluctuations.

For these reasons, we believe that bonds in today’s market conditions have still much to offer investors in terms of portfolio diversification and income enhancement, providing the investment strategies are active, global, multi-sector, well-researched and well-managed, and include currency hedging and suitable measures for managing liquidity risk.

John Taylor is a fixed income portfolio manager at AB (AllianceBernstein).