This article considers different measures of investment risk, describes their characteristics and contemplates their role in investment strategy.

Investors should consider which risk measure best reflects their preferences and the role of each portfolio component within the total investment strategy.

The investment strategy context for risk

When determining how to best measure portfolio risk, the role of that portfolio in the overall investment strategy is important.

Understanding the nature of the sensitivity of investors to variations in returns is critical to which type of risk is most relevant to them.

For example, post-retirement investors are likely to be more sensitive to short-term declines in value as they are closer to the drawdown phase of superannuation.

Conversely, young members have a 30-plus year time horizon. Their focus should be on achieving good long-term real returns.

Alternative risk measures

At the heart of this topic is the shape of the distribution of returns from a security or a portfolio.

There is a substantial body of evidence that short-term financial security returns are not normally distributed.

In particular, there is evidence of fat tails in investment security return distributions. Also, return distributions are not necessarily symmetrical.

Assessing and managing tail risk can be critical for many investors.

Tracking error

Tracking error is the standard deviation of portfolio performance relative to the return of its benchmark.

It is a relative risk measure, and it does not consider the riskiness of the benchmark itself.

Tracking error gives no indication of the average return of the portfolio relative to the benchmark.

A low tracking error only tells us that any under or outperformance of the benchmark has been achieved consistently.

Volatility of total returns

For some portfolio circumstances, total return volatility can be the primary portfolio risk measure.

One example is an equity portfolio within a conservative fund, designed for investors with a low tolerance for poor short-term returns.

Such a fund may have a limited appetite for equity risk given the funds risk/return objectives.

Downside risk

Downside risk concerns most investors. Standard deviation penalises returns above the average in the same way as returns of the same degree below the average.

A number of measures of downside risk exist, such as downside beta, semi-standard deviation of returns, the maximum drawdown or the Omega ratio.

The Omega ratio estimates the probability weighted ratio of gains to losses relative to a target return.

The maximum drawdown considers the peak to trough, the largest fall in the value of the security or portfolio during the period of review and the corresponding return.

Thus, it measures the negative return incurred if one invested at the local peak and sold at the trough.

Value at risk (VaR) has been a popular risk measure in finance. It estimates the potential loss at a certain confidence level during a certain time horizon.

One drawback is that it does not consider the size of potential losses beyond the VaR.

Conditional VaR (CVaR) is the conditional expectation of the losses exceeding VaR.

CVaR provides additional information on the magnitude of losses in the tail exceeding VaR.

Scenario testing

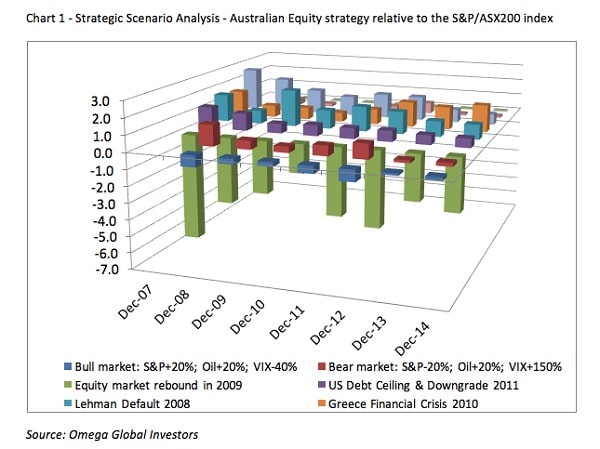

Omega Global Investors conducts stress testing of its investment strategies. Chart 1, below, provides one example.

This research can provide important insights into how a strategy might behave under defined stress situations.

Table 1, below, shows the strategy has lower volatility than the index and lower returns than the index in a rising market. Conversely, it shows significant outperformance in falling and sideways markets.

The analysis of its behaviour in different markets using various risk measures is helpful to obtain a deeper understanding of its potential performance characteristics.

Correlation with other assets or asset classes

Another key investment risk is the correlation of a security or portfolio with other securities or portfolios.

Low correlations with other assets are very important to reducing total portfolio risk. Importantly, the correlations between securities are not stationary, so the study of how correlations vary is integral to successful risk management.

Risk-adjusted returns

Investment returns achieved should be considered in the context of the risk incurred to achieve them.

Identifying the most appropriate risk measure given your investors’ investment needs and concerns is central to this task.

Common measures of risk-adjusted returns are the Sharpe ratio and information ratio.

The Sharpe ratio is the ratio of the excess portfolio return over the risk-free return to the volatility of portfolio return.

Information ratio is the ratio of the excess return of the portfolio over the benchmark return to the tracking error between the portfolio and the benchmark.

Types of risk

This paper focuses on different methods of measuring investment risk and how they can be relevant to investors with different needs. We leave to further research the topic of analysing the various components of fund risk, which include:

- Investment market risk;

- Factor risks such as growth/value, size, momentum, credit, interest rates, liquidity

- Security specific risk;

- Operational risk;

- Regulatory risk; and

- Legal risk

Liquidity risk is noted in APRA’s Superannuation Prudential Standard SPSS530 – Investment Governance, which requires a liquidity management plan.

That plan should include measuring and managing liquidity on an ongoing basis, and considering how the liquidity of investment options can be managed in a range of stress scenarios.

The detailed assessment of the liquidity risk of portfolios is an area of active research and strategy work at Omega Global Investors.

Conclusion

Investment risk is subjective. Each portfolio has its own characteristics and investment objectives.

No single measure of investment risk is ideal for all portfolios and investor circumstances.

A number of risk measures are presented, each of which can play a role in most effectively designing investment portfolios.

Determining the risk measure that best reflects the ambitions and concerns of your investors is a critical step in the investment strategy development.

Such a customised risk assessment enables the evaluation of the quality of portfolio returns on a risk-adjusted basis.

Scott Lawrence is head of investment solutions at Omega Global Investors.