Uncertainty is inherent in every financial model. Volatility is the most widely accepted barometer for this measure and has effectively become the expected price of uncertainty in markets.

One of the most profound findings in financial economics is that volatility can, to a large extent, be forecast, and there are a number of models available – the three most common being HIS (historical), autoregressive and implied standard deviation.

Predictability follows from some of the statistical properties of volatility.

The implications of volatility forecasts are evident in several ways.

Volatility reaches all corners of the economy. Inaccurate volatility estimates can leave financial institutions without enough capital for operations and investment.

Market volatility and its impact on public confidence can have a significant effect on the broader global economy, so the trade-off between risk (volatility) and return is critical for all investment decisions.

In addition, we believe there are relationships between volatility and asset returns that provide an opportunity to systematically increase the potential for risk-adjusted returns on investments (to varying degrees) by applying volatility forecasts to asset allocation decisions.

While the relationship between risk and return appears constant over long periods, the relationship fluctuates dramatically when analysing it over shorter time frames.

For example, over a 35+ year span in US equities and bonds data, the risk-reward profile of equities and fixed income has been quite different through the decades.

Latency (or volatility clustering) is the characteristic denoting that periods of both high and low volatility tend to persist.

This follows from the observation that large changes in asset returns tend to be immediately followed by large changes; the same is true for small changes.

To illustrate this, we calculated the autocorrelation (i.e. the correlation of one asset’s return to itself) of the absolute value of returns for three equity indices at different time lags.

Using the absolute value of the returns enabled us to focus on the change in magnitude of the return rather than the direction of the return.

The magnitude of future returns is generally dependent on the magnitude of past returns, with this dependence becoming weaker over time.

As a result of this relationship, past volatility actually has a reasonable amount of explanatory or predictive power over future volatility. The latency of volatility makes it significantly more forecastable than asset returns.

Another notable characteristic of volatility is the negative and asymmetric relationship between returns and volatility.

The calculation of volatility is indifferent to the direction of the market. However, volatility generally rises when the market falls and volatility tends to fall when the market rises.

It has been theorised that this relationship is fundamental in nature and is due to what is called the leverage effect. The leverage effect posits that as stock prices fall, companies become more leveraged as the value of their debt rises relative to the value of their equity. As a result, the stock price becomes more volatile.

How to target volatility?

The risk–reward trade-off is not constant – particularly over shorter time frames. This means that a static asset allocation can be ineffective.

With this in mind, volatility forecasting models are often used to improve upon a fixed asset allocation framework by allocating to a fixed level of volatility instead.

This is known as volatility targeting and enables a portfolio to potentially take advantage of volatility forecasts and make allocation decisions.

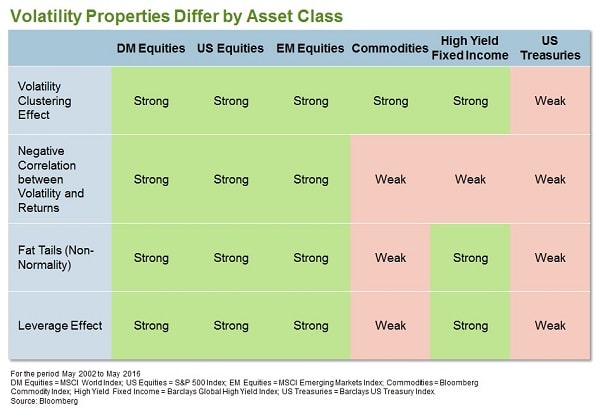

The return streams of different asset classes display differing degrees of these characteristics (Exhibit 1).

The ones which exhibit more of the aforementioned characteristics are better candidates for volatility targeting.

Exhibit 1 – Applications of Volatility Forecasting – Targeting Volatility

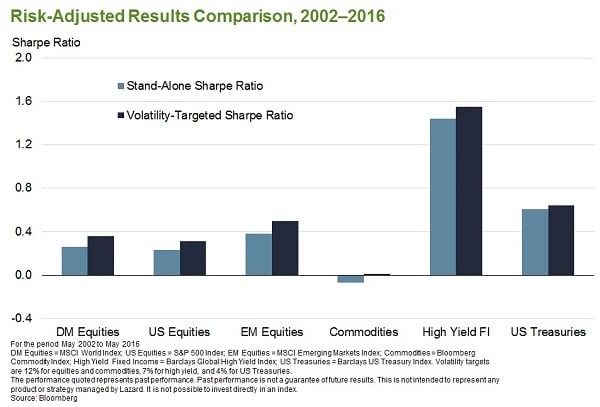

To illustrate the success of volatility targeting on different asset classes, we examined each asset class individually and then in combination with cash picking a volatility target.

The measure of success is the Sharpe ratio, a measure of risk-adjusted return. The more an asset class is favoured by volatility forecasting characteristics, the more risk targeting improves the results (Exhibit 2).

Exhibit 2 – Targeting Volatility – Results by Asset Class

Since US Treasuries exhibit none of the volatility forecasting features, the impact from volatility targeting on the risk-adjusted return is minimal.

Equities, on the other hand, strongly exhibit all of the characteristics; hence a volatility targeting approach can have a significant positive effect on the resulting Sharpe ratio.

The impact on commodities and high yield fixed income is minimal; although the latter has many characteristics that would favour volatility targeting, it does not have a strong negative correlation between volatility and returns.

Because a volatility targeting strategy involves being under-exposed to an asset class when its volatility is high and completely exposed when its volatility is low, a strong negative relationship between volatility and returns is a pre-requisite for volatility targeting.

High yield fixed income markets have historically experienced some of their strongest returns in periods when volatility was very high – in the 15 – 20 per cent range.

Different asset classes possess differing degrees of these statistical characteristics. This is the key driver of the impact that volatility targeting can have on risk-adjusted returns.

Equities in general have the best combination of these volatility properties which leads to the potential for favourable risk-adjusted results from a volatility targeting approach.

Stephen Marra is portfolio manager/analyst on Lazard Asset Management’s multi-asset team.