The low level of volatility in equity markets is being interpreted by some as a sign of investor complacency that will lead to eventual market collapse.

But a market without volatility would be unnatural – much like an ocean without waves – so it will eventually return.

However, the reality is that for the long-term investor, market volatility is largely irrelevant.

Don’t jump ship at the bottom

Focusing on the long-term market trends rather than short-term gyrations should give investors the confidence to ride the waves of volatility.

When examining historic equity market data, we see a trend of rebounds following equity market pullbacks.

That means that investors who jump ship after a big wave may have broken the cardinal rule of investing by ‘selling low’.

Every year, the equity market will experience a pullback or short-term drop.

Since 1994, the average size of that intra-year decline for the ASX 200 has been 14.3 per cent.

Despite this fact, the equity market has ended the year higher than it began in 17 out of those last 23 years.

That’s why it’s important for investors to ride the wave of volatility through its full cycle.

Frequent pullbacks in the market can be unsettling and tempt investors into trying to time the market – but they should not jump ship.

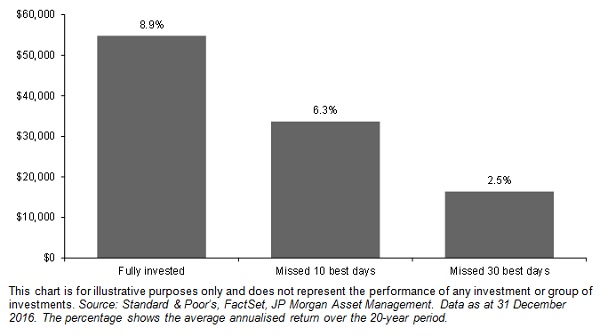

Being fully invested is particularly important when there is volatility because the best and the worst days in the market tend to be clustered together.

If you were lucky enough to miss the worst days, you also were likely to have missed the best days.

A fully-invested portfolio would have returned more than three times one that missed the 30 best days in the market over the last 20 years.

Additionally, as the majority of the best days occur closely to the worst market days, it is likely that investors who sold equity because of seasickness after a bad day often also missed a big rebound.

Performance of a $10,000 investment between 1 January 1997 and 31 December 2016

Total returns for the ASX 200 Index

Focus on the long-term destination

While volatility can cause major deviations in the near-term for equity markets, investors should focus on their destination.

Historically, the rolling returns for equities in a single year have varied from a loss of 38 per cent to a gain of 47 per cent.

But over a 20-year period, rolling annualised returns have been positive for the past 60 years.

Unfortunately, short-term investors are much more likely to realise the waves of volatility that occur over a one-year investment horizon.

Investors with long-term goals and the luxury of time are able to shift their focus to the long-term potential of equity investments and a smoother return profile.

Batten down the hatches with diversification

We live in a world of news overload and much of it is background noise rather than real information, and your portfolio should not be a dinghy tossed around by market churn.

Fortunately, it is possible to gain an element of portfolio stability through diversification. While equities tend to perform better with economic growth and moderate levels of inflation, rate-sensitive fixed income is important to portfolios when economic growth falters.

While a combination of various asset classes should improve portfolio returns, diversification is most useful when it comes to keeping a portfolio on an even keel.

Navigating volatility

Though it’s impossible to predict the future, expecting market volatility in the coming years is a safe bet.

Just as the last 20 years have favoured the diversified investor, we expect the next 20 years to do the same.

Investors need risk assets in their portfolios to reach long-term investment goals, and staying invested throughout that time horizon can be the biggest challenge.

History shows that diversification and rebalancing are the best tools for reducing portfolio volatility and providing a gentler ride through sometimes difficult seas.

Kerry Craig is a global market strategist at JP Morgan.