Political uncertainty is looming over financial markets. The spectre of further events on the Korean Peninsula, the threat of a US debt crisis and the ongoing Brexit negotiations all present significant challenges for investors.

However, markets have generally performed well year-to-date on the back of strong economic growth and low inflation.

Recent economic data, coupled with recent central bank rhetoric and activity, present a reasonable backdrop for risk assets, while we expect government bonds to remain an effective diversifier – at least in the near term.

Our rationale for such an outlook is laid out below, along with our views on the outlook for volatility, currency markets and real assets.

We believe an effective multi-asset portfolio should consider investing beyond mainstream equity and bond markets.

By incorporating holdings that are less sensitive to overall market direction, a portfolio can access a broader range of risk premia, enabling a degree of diversification that traditional strategies cannot match.

Strong growth and low inflation

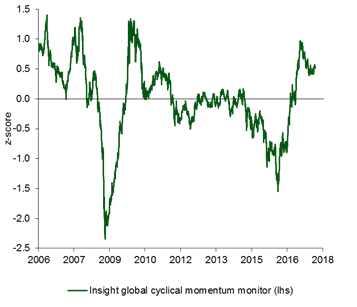

Markets have been driven in recent months by a global cyclical upswing (illustrated by Insight’s global cyclical momentum monitor in the chart below).

While economic surprises have rolled over and some economic data has moderated in recent months, financial conditions have eased and this suggests that any slowdown may well be delayed.

Source: Bloomberg, Thomson Reuters and Insight Investment

Growth has been particularly strong in the eurozone and the US, while inflationary pressures have been far more muted than expected. For example, wage growth in the US remains low relative to historical levels.

We therefore continue to expect reasonable growth to be achieved around the globe without it leading to a significant pick-up in inflationary pressure.

If this is right, then adjustments to central back policy, most importantly at the Federal Reserve (Fed) and European Central Bank (ECB), are likely to be gradual and aimed at financial stability, as much as keeping inflationary pressures in check.

Linked to that, the unwind of the Fed’s balance sheet – initially by slowly stopping the reinvestment of money earned on bonds bought via the quantitative easing process – should be a well signalled and steady affair.

In Europe, the relative strength of key activity numbers suggests it won’t be long until the ECB starts to taper its bond purchases and reduce the size of its balance sheet.

Risk assets

From a broader asset allocation perspective, whether there is a continuation of the co-ordinated global growth/low inflation story that has emerged over the last few quarters is key for the performance of risk assets – geopolitics notwithstanding.

The better performance of risk assets over the last year has reflected the improving growth backdrop and strong corporate earnings in both the US and Europe. How long this trajectory can be maintained is unclear, but we expect equity markets to remain highly sensitive to the prospective growth outlook.

Beyond a relapse in growth expectations, could a rise in bond yields derail the party for risk assets?

Our analysis above as to the likely path for Fed and ECB activity suggests that adjustments to both the Fed’s and ECB’s balance sheets may ultimately give yields an upward bias – but the longer end of yield curves should be supported as long as inflationary expectations remain well anchored.

We would expect a well-behaved government bond market, combined with solid but not spectacular economic growth, to continue to provide a reasonable backdrop for equity and credit.

Defensive assets

The role of defensive assets, namely government bonds or cash, ultimately depends on their likely behaviour in relation to the other assets in a diversified portfolio.

Over the summer, an apparent reassessment of central bankers’ views on monetary policy led to short-term sell-offs in equities and bonds, but over the medium term we think the future path of rates will depend on the trajectory of growth and inflation.

As noted above, we believe the growth backdrop and trajectory of central bank policy is sufficient to suggest slightly higher yields, but the lack of inflationary pressure indicates government bonds will retain a place as a diversifying asset at least in the near term.

Cash, volatility and real assets are alternative diversifiers should inflationary risks build.

Volatility

Clearly, markets struggle to cope with the probabilities associated with geopolitical risk, but recent bouts of volatility have been relatively short-lived and muted.

While the VIX Index fell to 10-year lows in July, the worsening situation in North Korea caused it to spike to a 2017 high of 16 in August. While this level appears high compared to the recent past, it is only in line with the average value for 2016.

More sustained increases in volatility are usually the result of economic slowdowns.

Unless we see ongoing threats of military escalation, renewed concerns regarding China or central banks aggressively tightening monetary policy, we believe volatility is likely to remain low.

As for the threat of a US debt crisis, even if there is ultimately a shutdown, we would not expect a significant impact on the economy or financial markets – shutdowns tend not to last very long due to the public backlash.

Generally, we view volatility spikes as a potential opportunity to profit from any dislocations in asset prices.

Currently in equity-land, relatively low levels of index volatility are not only due to low single stock volatility, but also due to low levels of correlation between stocks, and we do not see low volatility as necessarily being a sign of complacency.

Currency

We believe European macro variables are unlikely to continue their recent outperformance, but we expect the euro to remain firm over the short term, which would weigh on European equity markets. By contrast, the lack of any progress on Brexit negotiations suggests UK stocks should continue to benefit from sterling weakness over the next few months.

Real assets

Commodities have mixed drivers with rising cyclical demand being offset by supply headwinds. Fading global inflationary forces mean that the hedging attraction of the asset class has fallen.

We believe selected asset-backed securities in high-grade residential paper are attractive. The asset class has received significant inflows but spreads versus investment grade credit remain attractive.

As for infrastructure, we believe exposure to selected infrastructure securities with an operational bias, and strong and stable long-term cash flows, will continue to act as effective diversifying assets.

How to position a multi-asset portfolio

From an asset allocation perspective, diversification is normally associated with investing across a range of asset classes, but we believe effective diversification involves combining different sources of return.

By blending the active management of directional risk (making money when markets go up) across a range of assets, with less directional strategies (which aim to make money whether markets go up or down), it is possible to take advantage of a broader opportunity set, enabling return generation across a range of market conditions.

Less directional strategies might include relative value positions, which favour one market or financial instrument over another; or strategies that perform if a market either remains within a specified range or breaks out of it.

We believe that blending the active management of directional risk with less directional strategies, and having wide flexibility to change levels of exposure across the investment universe, can help to deliver a smoother investment journey and provide a better distribution of returns – both of which are essential to achieving attractive medium-term growth with lower volatility than equity markets.

Matthew Merritt is the head of Insight Investment’s multi-asset strategy group.