To be a true to label ETF, one of the criteria is the fund must track a reference index, and it is this index that drives the performance and risk outcomes of the ETF.

While the fees, the expertise of the issuer and the way the ETF replicates its index are also important, these considerations should only be assessed once investors fully understand the ETF’s reference index.

There are four critical questions that investors must ask to assess an index:

1. Does the index match your investment objectives?

Your ETF investment, and therefore the index it tracks, should match your risk profile and the outcome you are trying to achieve.

Investors need to examine whether the purpose of an index, such as exposure to an equity or bond market, meets the investor’s own investment objectives and risk profile.

2. Is the index concept supported by research and experience, or is it a fad?

Index design should be supported by reputable research and have a minimum of three years’ historical tested data from a reputable index provider.

3. Is the index easy to understand?

Can you explain the index to someone else? If you can’t, do you really understand what investment the ETF is offering?

The more complex it is, the more uncertain the risks and investment outcome are likely to be.

4. Does the index perform as you would have expected?

The index’s historical data should be readily available so you can assess the past performance of the index to determine if it does what it claims to do.

Let’s now use this framework to assess two Australian equity indices.

Assessing the S&P/ASX 200 Index

Does the index match your investment objectives?

Exposure to a diversified portfolio of Australian equities will potentially help you achieve growth over the long term.

The S&P/ASX 200 captures the top 200 companies of the Australian share market, including them proportionately based on their market capitalisation.

However, if you are also seeking diversification, the S&P/ASX 200 exposes investors to concentration risk.

The top 10 companies represent nearly 50 per cent of the index. The top four companies are banks. Financials make up around 40 per cent of the index.

Such concentration is problematic if bubbles form.

Is the index concept supported by academic research and experience, or is it a fad?

No, it’s not a fad. Market capitalisation weighting has been the dominant index weighting method for many years.

Is the index easy to understand?

Yes. The S&P/ASX 200 is quoted in the media and is the standard Australian benchmark index.

Most investors understand that, in a market capitalisation index, a company’s weight is determined by its size.

Does the index perform as you would have expected? Is it true to label?

Yes. If the media reports the Australian share market rose 2 per cent, it’s likely the S&P/ASX 200 rose 2 per cent.

With a market capitalisation index such as the S&P/ASX 200, the largest companies have the biggest impact on its performance.

Therefore, if Australian banks do well, so too will the S&P/ASX 200.

Because of this skew towards large companies’ returns, the S&P/ASX 200 doesn’t track the overall share market as well as it tracks the performance of large listed companies.

Assessing the MVIS Australia Equal Weight Index

Does the index match your investment objectives?

Exposure to a diversified portfolio of Australian equities will potentially help you achieve growth over the long term.

The MVIS Australia Equal Weight Index currently includes 79 Australian companies.

The Equal Weight Index, as the name suggests, gives each stock in the index an equal weighting, so a mega-cap company has an equal weighting to a large- or mid-cap company.

This equal weighting strategy gives the index greater diversification than the S&P/ASX 200 Index. In fact, research shows that the Equal Weight Index is three-times better diversified than the S&P/ASX 200

Is the index concept supported by academic research and experience, or is it a fad?

Yes. It is not a fad. Equal weighting is a strategy that has been around since the 1970s.

Many academic institutions such as The University of London’s Cass Business School, EDHEC Business School, Goethe University and Australia’s own Monash University, demonstrating the long-term outperformance of equal weight investing.

These findings reinforce industry research by index companies S&P Dow Jones Indices and MV Index Solutions.

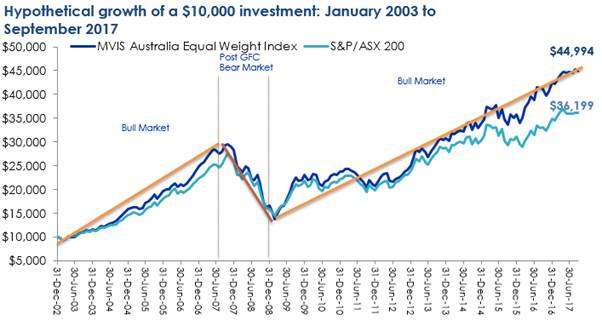

The experience in Australia has matched the research, where the Equal Weight Index has outperformed the S&P/ASX 200 Index in 11 out of the last 14 years.

Is the index easy to understand?

Yes. In fact, it’s arguably as easy as it gets. An equal weight index simply applies the same weighting to all stocks to be included in the index.

Does the index perform as you would have expected? Is it true to label?

Yes. The MVIS Australia Equal Weight Index enhances diversification and is true to label. Over one, three, five and 10-year periods it has outperformed the S&P/ASX 200. This is demonstrated in the graphs and tables below.

You now have a robust framework to assess the index that underlies the ETF you are considering. It is the most important consideration as it will drive your ETF investment’s performance.

Russel Chesler is the investment director at VanEck Australia.