Investors in Australian equities are often reminded of the concentration risk of the Australian market, with the big four banks and resources companies accounting for a large proportion of the market.

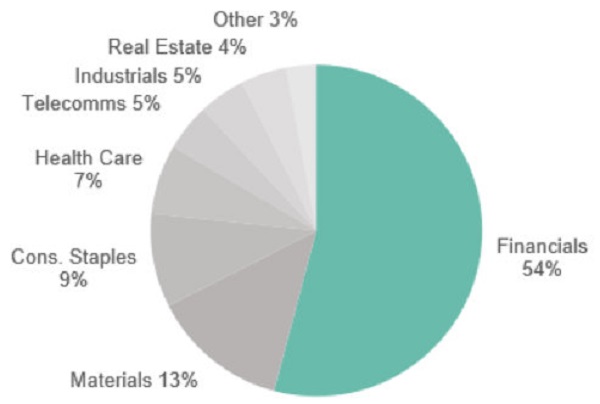

If we look at the composition of the S&P/ASX 20 Index as at 1 January 2018, nine companies in the financial category account for 54 per cent of the market capitalisation.

This group of nine includes household names such as Commonwealth Bank of Australia, Westpac, ANZ, National Australia Bank, Macquarie Group, AMP and IAG.

S&P/ASX 20 index weight by sector

Source: ASX

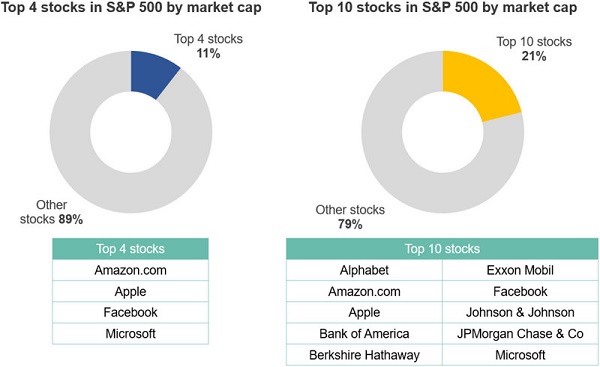

For investors looking at offshore opportunities in the US for example, the concentration theme plays out in a slightly different way.

As you can see from the charts below, technology companies replace banks. As at 31 December 2017, the top 4 stocks in the S&P 500 were all technology companies and accounted for 11 per cent of market capitalisation.

The top 10 stocks included five technology companies and accounted for 21 per cent.

Sources: Morningstar Direct, Standard & Poor’s

In addition to concentration risk, investors also need to consider the issue of valuations. For some time now, good quality companies listed on the ASX and global stock markets have been trading at full valuation.

The big four Australian banks are often cited as being fully valued, but there are several listed companies that don't pass famous value investor Benjamin Graham's hurdle.

While you may be able to look at a particular index and construct a diversified portfolio that mitigates concentration risk, it is likely to be an expensive exercise given the current environment, where you ultimately end up holding a portfolio of fully valued assets.

Using a benchmark unaware approach

A benchmark unaware portfolio construction approach allows an investment manager to use their research expertise to actively identify the best, risk-adjusted opportunities, regardless of the composition of any theoretical or actual index.

As a long-term value manager, we have the flexibility to apply our investment philosophy and approach without the restriction of referencing a particular benchmark.

The benefit for investors is that we only invest in relatively inexpensive quality companies that satisfy our ‘margin of safety’ criteria.

We value each prospective business using a discounted free cash flow model and only invest when the share price is at least 20 per cent below this assessed value.

This forms the basis of our ‘margin of safety’ and is critical in protecting capital, minimising the chance of permanent losses and achieving high returns.

In our view, price is what you pay and value is what you receive. Over time, we’ve seen that a company’s share price will trend toward its true intrinsic value.

Accordingly, our investments in world-class businesses have two powerful factors working simultaneously: the value of the business is growing, while the share price is playing catch up to this value.

The beauty of a benchmark unaware approach is identifying and then owning shares in well-managed companies, which are often not household names, growing their market share and delivering great results. Examples from our portfolio include Fairfax India and Discovery Communications.

At the end of the day, a commitment to benchmark unaware portfolio construction is about discipline.

The discipline to: actively research companies, understand the value proposition and invest for the long term.

By moving beyond short-term factors, as well as the emotional not economic and investment fundamentals, that often dictate the price of listed companies, we have successfully constructed a diversified portfolio of world-class businesses operating in major centres around the globe.

Alex Haynes is head of distribution at Peters MacGregor Capital Management.