Inflation is dead

Bond investors have gotten very comfortable in a world of muted inflation, and may be in for a surprise in 2018.

Short-term inflation measures have started to pick up, particularly in the US. Business investment shot up in 2017 – and higher investment is typically associated with higher productivity, which has historically fuelled wage growth.

Monetary policy expectations have not adjusted to this changing picture. In Europe, interest rates are still at crisis levels, and the market is not pricing in the first hike until the end of 2019.

But we feel that Europe is not in crisis – in fact, it’s a big economic success story. Given that yields on nearly a third of the European bond market are still in negative territory, a pain trade looks likely to lie ahead.

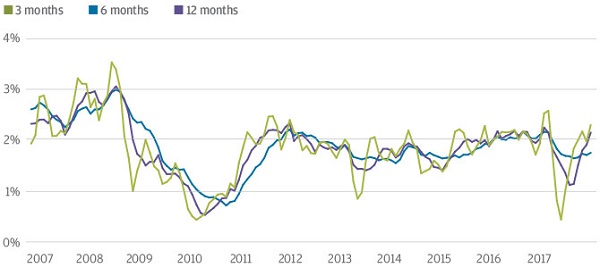

Inflation momentum has been gaining pace in the US, as shown in the graph below.

Change in average of core inflation measures. %

Source: Bloomberg, J.P. Morgan Asset Management; data as of 31 December 2017. *Average of core inflation measures includes core CPI, sticky CPI, sticky CPI ex-shelter, median inflation, trimmed mean inflation. CPI = Consumer Price Index.

Politics will disrupt markets this year

While investors are complacent about inflation, it’s possible they’re too worried about political risk.

There are 84 elections slated for this year globally – roughly one every four days – but compared to the dramatic ballots of the last couple of years, these look set to be much less disruptive, with nothing on the horizon that appears likely to have a significant effect on growth/inflation dynamics.

Credit is a bubble

The consensus view is that the party is over in corporate bonds and returns are bound to falter.

But operating metrics for corporates look robust, with leverage trending down and interest coverage trending up in European high yield, and earnings and revenue growth solid in both the US and Europe.

The risks? First, that the economy slips into recession – not something we think is imminent. Second, that companies begin to misallocate capital.

We look at use of bond proceeds as a forward indicator: currently, two-thirds of proceeds from new issuance are being used for refinancing – a conservative use of capital – but we’re watching for signs that companies are leveraging up their balance sheets.

Another warning sign would be a pickup in merger and acquisition activity.

If we’re right that the risks are remote for the time being, we could see spreads come in further. Global investment grade spreads of 94 basis points (bps) could tighten to 80 bps. We don’t expect to get back to US high yield’s all-time tights of 225 bps, but current spreads of 363 bps could compress to 300 bps.

All emerging markets are equal

While the major developed markets are differentiated in investors’ minds, emerging markets are still often treated as a homogeneous group.

But dispersion among emerging markets has never been greater – as evidenced by both returns and yields. The yield on the local currency emerging market debt index is 6 per cent, but Argentina is yielding over 16 per cent, while Hungary is yielding just 1.2 per cent.

We currently favour countries with high real yields and the potential for further compression, such as Indonesia and Russia.

We are less positive on countries where the central bank is behind the curve, and where we see a risk of rising developed market rates spilling over, such as the Czech Republic.

It’s all about the income

Fixed income is about income, right? The clue’s in the name. But while this used to be true, and investors could gather a steady 5-6 per cent income from their bond investments, the picture is very different today.

This year’s market is likely to be one in which fixed income investors will need to generate capital gains – and avoid capital losses – to produce returns. The late-cycle environment will be more idiosyncratic, and we expect investors to need to be more selective if they are to thrive.

Times they are a-changin'

The ‘lower for longer’ story is changing. The tools that helped keep rates low have done what they set out to do, and now we’re entering a rising rate environment.

It’s important now, more than ever, for investors to be flexible in their fixed income approach, look for strategies that have a more unconstrained approach, and, critically, focus on strategies that offer downside protection.

Nick Gartside is JP Morgan's international chief investment officer for fixed income.