The LIC market has more than doubled its market capitalisation to $37.9 billion in the six years to March 2018 – and there have been sweeping changes in the availability of investment strategies and managers on offer.

We have also witnessed escalating debate from pundits on both side as to the merits or otherwise of investing in LICs.

There is no doubt that the reshaping of the LIC market has been dramatic.

For decades, issuers were dominated by a comparatively small number of large companies.

These issuers adopted a traditional internal management model, where the investment managers were employed within the company as a singular organisation.

In March 2010, the top five LICs by market capitalisation made up 65 per cent of the sector, with internally managed companies accounting for 80 per cent of the total.

Fast forward eight years and that figure is very different. The top five LICs still make up a hefty 50 per cent of the market capitalisation; however, only the top three are internally managed.

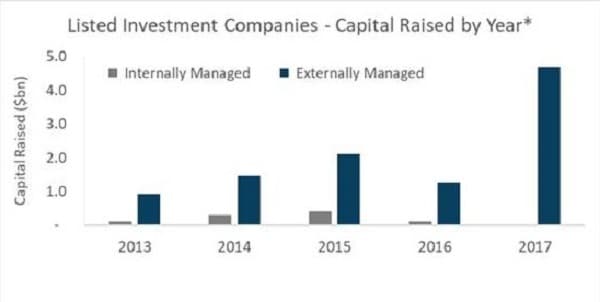

Even more startling is that externally managed LICs, those where investment management is provided by a third party, have surged to make up the majority of the sector.

Externally managed LICs broke through 50 per cent of total market capitalisation in early April 2018. This inflection point came with the announcement of the second largest LIC IPO in history, with the externally managed L1 Long Short Fund Limited raising more than $1.3 billion.

Recent trends also highlight the changing appetite of investors, with greater movement to global rather than domestic strategies.

In addition, this showcases the appetite of unlisted fund managers to embrace the LIC model.

Drivers of change in LIC interest from fund managers

There are three key forces underpinning the surge in fund manager interest.

As a result, advisers should understand the motivation behind fund managers launching LICs before investing, and the implications for users of such vehicles.

One of the most appealing features of an LIC for fund managers is that portfolios can be managed without the need to buy and sell positions in response to investor flows.

- This helps quarantine the impact of investment flows on portfolio performance, which in theory at least, should make life easier for fund managers and benefit existing investors.

- LICs allow fund managers to earn recurring fees from the IPO that is also quarantined from future fund flow movements. As LICs are closed-ended vehicles there is reduced potential for destabilisation of business revenue if large investor mandates are withdrawn. However, this obviously has the potential to cut both ways in terms of manager/investor alignment.

- Investors can benefit from the relative ease of access to LICs versus unlisted managed funds. The paperwork for investors, particularly if self-directed, is prodigious and frequently cited as a disincentive to users. As a result, fund managers are increasingly taking the approach of building multiple entry points to an investment strategy and letting the investor choose which avenue best suits them.

LICs: What to look out for

Ultimately, the enthusiasm for adopting alternative access points should not materially undermine investment efficacy.

A new investment structure does not always mean it is better for every investor under every circumstance.

Selection of LICs, particularly when participating in an IPO, needs to take into account the issues above, and beyond the talent and robustness of the investment manager.

Estimation of the scale and tradability of a LIC post-listing is imperative.

While there have been a number of high-profile listings which have recently raised material amounts of capital (and therefore facilitating liquidity on the secondary market), there are also others that in the absence of workable strategies going forward, run the risk of being effectively orphaned by their managers.

The lure of a niche strategy and favourable returns is little comfort if the LIC has poor tradability, as this also tends to have implications regarding where an LIC trades versus its net tangible assets (NTA).

LICs also present unique challenges for portfolio construction. Their listed nature means that the performance characteristics of the underlying investment portfolio will inevitably not mirror shareholder returns.

When utilising a simple domestic long-only equities strategy, this is not an insurmountable issue.

However, when taking on offshore or more alternative strategies (long-short, market neutral etc), the share price is likely to correlate more with the Australian equities market, particularly in periods of stress.

This can materially negate the effectiveness of such strategies and make portfolio allocation problematic.

Also, there is the issue of shareholder engagement, adequate transparency and corporate governance.

As LICs are listed companies in their own right, this is of critical importance in maintaining shareholder confidence.

Negative sentiment or shareholder dissatisfaction, if ineffectively addressed by the LIC’s board and/or investment manager, can see share prices rapidly unwind from the portfolio NTA.

This scenario was played out recently, where a listed investment company came under scrutiny regarding disclosure issues.

Management’s initial response was poorly crafted and largely ineffectual.

This drove a collapse in shareholder confidence and saw the LICs share price to NTA fall from a 0.6 per cent premium to a 33 per cent discount in a matter of days.

There are certainly a number of high-quality operators of LICs in the market.

However, in the race to go live with products, LIC operators need to ensure an alignment of product interests between the fund manager and the investor, particularly as this dynamic is amplified in a listed market setting.

As the opening quote infers, investment managers need to ensure that product development provides the proper fit between all parties in the market, and that pursuing LICs is not merely a race to build another distribution channel.

In turn, advisers need to make sure they have tools to make a proper determination of the attractiveness of new products.

LICs have potential advantages, but require rigorous analysis

LICs have become an increasingly popular choice for advisers seeking an investment vehicle for their clients that is easily tradeable, relatively transparent and simpler to receive franking credits.

For fund managers, the attractiveness of LICs stems from the growing distribution opportunity as well as advantages in quarantining their portfolio from investor fund flows and at a captive fee base.

Notwithstanding their advantages, LICs require a higher level of investment analysis from rating houses such as Zenith.

This is because they are at the intersection of two key issues, listed company governance and investment manager process.

Advisers need to assess whether LICs are appropriate for their clients in the context of both criteria, as each can influence the total return to the investor and the applicability of portfolio inclusion.

Part of this assessment should take into consideration the motivation of the issuing LIC, why they are launching their capability and their alignment with your clients’ interests.

Dug Higgins is head of property and listed strategies at Zenith Investment Partners.