It’s worth highlighting that most business models within the infrastructure space have mechanisms in place to pass through inflationary pressures.

Utilities generally have clearly defined regulatory paths to allow for adjustments during periods of inflation. Energy pipelines and many real estate contracts similarly have CPI-adjustment clauses that allow revenue to rise along with costs.

Toll roads and airports have it even better; with CPI-adjustment clauses in their contracts and an established fixed-cost base, many of these businesses will see higher revenues and little change to their cost structures in a rising rate environment.

It is a misconception that these businesses cannot perform well in a rising rate environment.

Investing in infrastructure involves an in-depth understanding of the mechanisms that allow these businesses to maintain or even expand earnings in the face of inflation.

When analysed properly, the hard assets underpinning infrastructure equities can provide a natural hedge in an inflationary environment.

Averages can mask volatility, and investors are often most concerned with the extremes. Since I started managing infrastructure equities seven years ago, we have seen a fair amount of interest rate volatility, but two periods stand out.

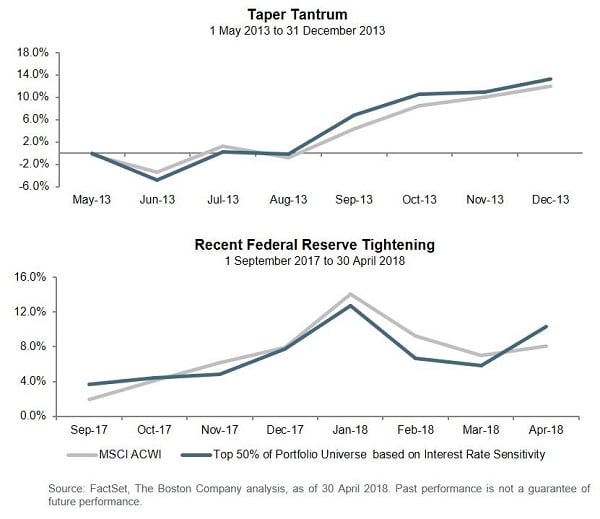

First, 2013’s ‘taper tantrum’ sparked an eight-month period when the US 10-year Treasury rose 160 basis points and bond proxies sold off in sympathy.

The second period of interest rate regime change began more recently, starting in September 2017. Over these eight months the US 10-year Treasury moved up approximately 100 basis points, with yields exceeding 3 per cent for only the second time during the last seven years.

How do you manage for rising interest rates?

We calculate a proprietary factor across our entire investable 500 stock universe, which measures each company’s sensitivity to changes in interest rates — effectively calculating each stock’s “equity duration.”

We do not use this factor to express a view on the direction of interest rates, but rather, we use it to control risk as we seek to ensure that we are properly balanced, or neutral, to macro factors.

We believe predicting macro factors is a far more volatile pursuit, and one that few, if any, managers can consistently do well.

By virtue of our expanded 500 stock opportunity set, we are able to invest in infrastructure securities that not only hold up well but, in fact, actually tend to outperform broad equity markets during a rising rate environment.

As a result, a key focal point for us is to always have exposure to this mix of businesses.

To illustrate, the charts below demonstrate the performance of the half of our 500 stock universe with the lowest equity duration.

Against this group, we plotted the performance of MSCI ACWI over two of the most extreme interest rate regime changes in recent history – the same two periods detailed above.

As expected, the global equity market performed quite well during both periods. Surprising to many is that the selected half of our universe (securities with lower equity duration) not only kept pace, but in fact outpaced global equity markets over both timeframes.

In reality, a full half of our investable universe has the ability to outperform broad global equities in rising rate environments.

After a prolonged period of ultra-low global interest rates, conditions are beginning to change. Rates have moved higher over the past eight months, and consensus has shifted to expect moderately higher rates over the next several years.

Of course, investment managers and strategists will have a wide array of opinions on where inflation and interest rates go from here. Investors should consider a broad infrastructure portfolio, particularly with a neutral approach to interest rate factors as part of their inflation hedging strategy.

James Lydotes is a senior portfolio manager for global infrastructure equity at BNY Mellon Investment Management.