As a result, both passive and active managers now provide a range of ESG offerings. The two different approaches are distinguished by one key factor: engagement.

The scoring methodologies, proprietary algorithms and data science used by passive managers can certainly help rank companies’ historical success with regards to ESG. But these methods cannot find the best-rated ESG companies of the future.

Active fund managers speak directly to company executives to foster real and lasting change, supplementing the data with human judgement. This deep engagement is the ESG X factor.

ESG in the rearview mirror

In broad terms, the primary role of active investment managers in the past has been to generate economic returns for asset owners. But, asset owners themselves are increasingly looking to asset managers to provide stewardship as part of the package.

Investments need to provide a positive impact on the wider society, in addition to economic returns – or at least not have a damaging impact on society.

The passive investment industry has responded in its own way, mostly by developing ESG scoring methodologies. Passive funds (by definition) cannot generate alpha, but they can create vehicles which track ESG indices, such as the Dow Jones Sustainability Index or any other (I count at least 39 different providers of ESG indices).

Many passive ESG indices and strategies sort and score securities on available data alone. This approach is inherently backward-looking. Because they dispense with forward-looking human judgement and intense engagement with companies, passive strategies can’t identify leading ESG corporates of the future.

ESG indices use various methods to organise which constituents are included. But the outcomes are binary - either a company is included in the index, or it’s not. If only life were so simple.

Exclusion lists do play an important role in ESG considerations, as asset owners and their fiduciaries determine that some business models simply cannot meet the social and societal norms. But this is only one small element of a complete ESG consideration set.

Engaging for the future

To assess future change, human judgement is essential. Robots, while very effective at sorting data and recognising patterns, cannot engage with company leadership.

Engagement requires an assessment of what the future looks like. And using a deep pool of analytical resources provides a considerable advantage in judging how a fluid matrix of trends and factors will develop over time.

Armed with these insights and judgements, investors can more effectively enter into constructive, detailed and fruitful discussions with companies.

In capital markets today, engagement can take on two forms: fostering change or imposing change. We strongly believe that fostering change is the most effective way to get corporates to modify their behaviour in a lasting way.

Bringing this to life for a minute - consider some of our conversations with companies in the metals and mining space.

In a previous era, our meetings with management could have begun and ended with a review of profit, current and future investment, and expected returns.

In recent years, however, knowing that ESG factors have an impact on share price performance and on communities, our conversations also focus on mine safety.

Our long-lasting engagement with these companies has helped to elevate the focus on mine safety to the beginning of the debate. Returns, as ever, remain critical, but management teams are now ever more focused on their impact on the community.

Putting our money where our mouth is

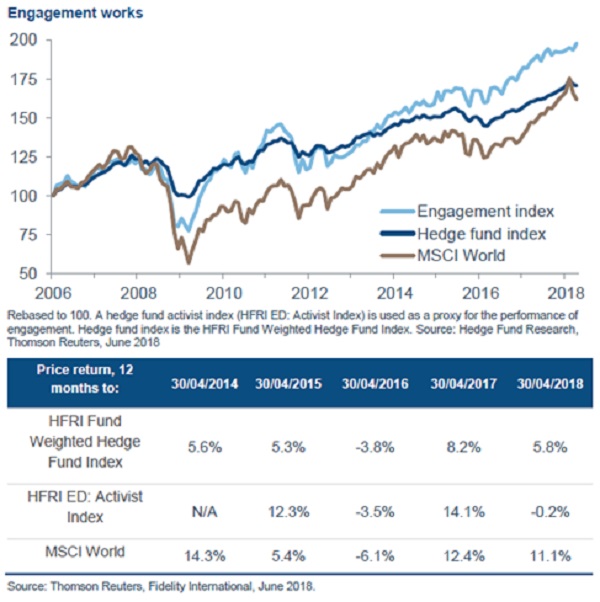

In terms of long-term performance, engagement strategies can deliver superior returns. Using activism as a proxy for engagement (this includes both disciplines of fostering change and forcing change), the chart below compares engagement against broader indices.

Conclusion

A strategy of active engagement gives the asset owner more certainty that their investment will foster the enduring, positive social impact they desire.

ESG indices can help to benchmark ESG standards, draw attention to ESG issues, and help to offer investors passive ESG investment vehicles.

But, in their current form, these vehicles cannot deliver the economic and social benefits associated with engaging with companies to bring about change in the future.

Our work with the corporate sector in recent years has shown that we can alter the behaviour of companies for the good of society, while preserving and enhancing shareholder returns for the asset owners.

I’m convinced that engagement has real long-term benefits as incentives become increasingly aligned between asset owners and companies seeking capital from financial markets.

But making a difference here all comes down to engagement – a scoring mechanism is simply not enough. A dedicated and active manager can go where an algorithm can’t – the boardroom.

Ned Salter is the head of research for Europe at Fidelity International.