A bias towards domestic equities is not uncommon in developed markets but the strong tilt towards local shares has historically been particularly marked in Australia, driven by a range of factors including benefits offered by dividend imputation credits, investor familiarity with the domestic market and global currency concerns.

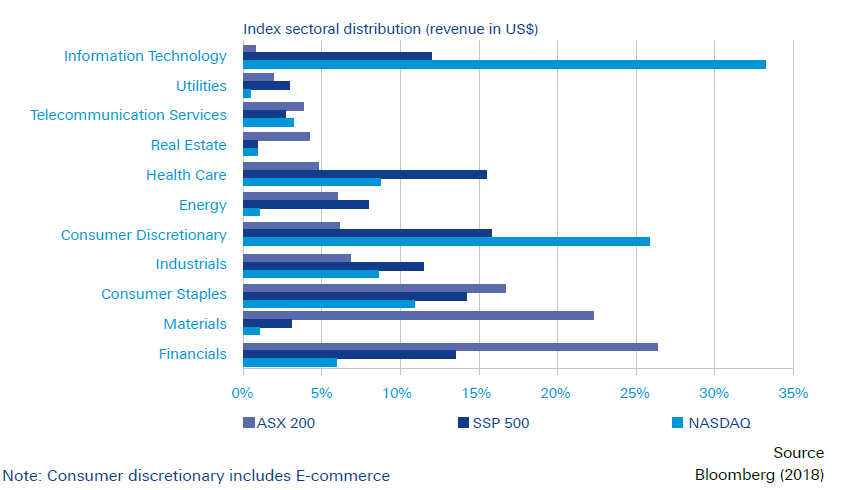

However, since the Global Financial Crisis, the disparity between returns yielded from the Australian share market and global markets has continued to widen. This can be attributed to the local market’s reliance on financial, industrial and materials sectors, which together account for over 50 per cent of the Australian equities market.

Index sectoral distribution comparisons for Australia and US

In comparison, major global indices are more balanced with higher weightings to growth sectors including technology and healthcare. This has rewarded global investors with superior returns as markets recovered.

Comparative performance for major Australian, US and all-world share market indices (February 2008 - February 2018)

Source: Bloomberg

These differences were accentuated further in 2017 when global markets soared off the back of a buoyant technology sector and growing consumption. Australia’s returns lagged behind global indices yielding just over 11 per cent for the calendar year compared to 21.9 per cent for the US and 31 per cent for emerging markets.

Source: Tradingview.com

Australian retail and institutional investors are now increasingly looking beyond the domestic market, which makes up just 1.8 per cent to 2.4 per cent of global equity markets, to overseas markets in the search for better sources of diversification and growth.

This strong appetite for international opportunities is highlighted by Australia’s ETF market, which broke the $40 billion barrier in 2018. Overall international share ETFs saw inflows of $1.3 billion in just the first half of 2018, more than double the inflows for Australian Equity ETFs.

Chi-X unlocking US market access

Until recently, direct ownership of individual US stocks has been a somewhat difficult process and fraught with challenges. Historically, Australians looking to gain meaningful exposure to global growth stories have been required to open a US-based brokerage account.

To remove this market impediment and plug what was an obvious gap in market efficiency, Chi-X (in partnership with Deutsche Bank) launched TraCRs (an Australian Security), which enables Australian investors to buy and sell a beneficial interest in leading global shares through a local broker during Australian trading hours, in Australian Dollars and on a local exchange.

As a result, TraCRs remove the foreign brokerage fees and decrease US custody fees which are currently imposed on Australian investors when buying or selling US equities. Dividend distributions are also paid in Australian dollars at wholesale exchange rates, adding value in purchasing TraCRs as investors receive further cost savings.

These savings are realised through Chi-X’s partnership with Deutsche Bank, the world’s largest foreign exchange trader, which is also acting as the custodian in the US, providing these services to investors at a wholesale cost.

TraCRs, which are classified by ASIC as an equity market product, give holders a beneficial interest in a single underlying share traded on the NYSE or NASDAQ. This means that TraCR holders can exercise voting rights and exchange TraCRs to the underlying share at a ratio of 1:1.

The first Apple Inc. TraCR (TCXAPL) was launched on 4 October 2018 and investors can now access a range of global blue-chips including Microsoft, Facebook and Disney with additional tranches to come in the future.

Like any domestic security, TraCRs can be bought or sold through local brokerages with clearing and settlement taking place in Australia’s Clearing House Electronic Sub register System (CHESS).

TraCRs will likely become a popular vehicle for Australian SMSFs, retail investors and institutional investors who want to diversify their portfolios into global growth sectors in an easy and cost-efficient manner.

Since entering the Australian marketplace in 2011, Chi-X has continued to grow its market share and now accounts for 20 per cent of average daily cash equities trading and 36.5 per cent of ETF volume, providing cost savings and diversification benefits to investors and traders.

Vic Jokovic, chief executive, Chi-X Australia