The merits of passive equity investing have had plenty of debate over the years, but one area only now getting the attention it deserves is how passive investing stacks up in an after-tax performance sense. This aspect of passive equity investing is relevant to Australian super funds because, unlike their global peers, they pay tax on their investment earnings. So whether a passive equity portfolio is really building wealth for super fund members depends, in part, on how tax efficient the strategy is. APRA’s new heat map “ups the ante” on after-tax thinking by setting benchmark assumptions about the level of tax funds should be paying on their investment portfolios.

To date, some passive managers have been clever in promoting a simplistic, and ultimately misleading, message that tax efficiency is all about keeping turnover low. As we demonstrate below, this idea fails to recognise the complete tax management opportunity set available within a passive equity portfolio.

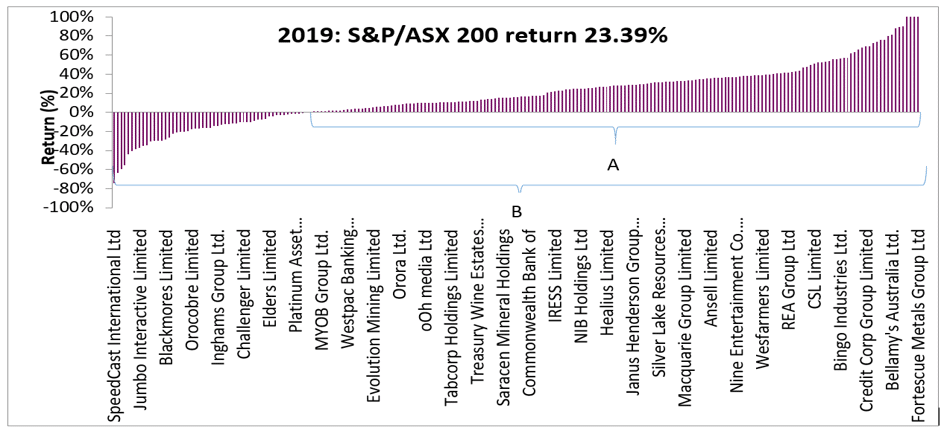

One key difference (amongst many) between a “keep turnover low” approach to tax management and a genuine after-tax investment approach is expressed in the chart below showing the gain and loss characteristics of an S&P/ASX 200 index portfolio over the 2019 calendar year. Set A represents the limited opportunity to manage taxes in a “keep turnover low” approach – a traditional passive strategy that is tax naive. Tax efficiency in this sense involves deferring taxable realised gains and, where realised, qualifying for a lower capital gains tax rate (10 per cent instead of 15 per cent) on the trades. Contrast this with set B, which represents a genuine approach to tax management. This captures not only the opportunities in set A but also the other 24 per cent of opportunities to unlock losses that have no after-tax value until realised. Our 2019 calendar year example is a conservative case, given the index returned a stellar 23.39 per cent pre-tax over the year. Over the past five years, this neglected opportunity to improve tax efficiency has represented as much as 61 per cent (2018) of the portfolio, and 35 per cent on average.

Sources: Parametric, S&P®, 2020. Index constituents are provided for illustrative purposes. Not a recommendation to buy, sell, or hold any security. It should not be assumed that any of the securities listed were or will be profitable. Not intended to reflect any investment strategy offered by Parametric. It is not possible to invest directly in an index. All investments are subject to risk of loss.

In fact, the opportunity set for real tax efficiency is much richer than this. The expanded opportunity set can be exploited day-to-day (not just each year end), as the stocks move between gain and loss positions with normal sharemarket volatility. And, of course, there are many other levers to manage capital gains, dividend and withholding taxes, and franking credit entitlements, beyond what we have demonstrated above, when a genuine after-tax focus (with after-tax performance reporting and benchmarking) is adopted.

Let’s put some return numbers to this. Pursuing a tax-naive (A) over a genuine after-tax (B) passive strategy can have meaningful performance ramifications for a super fund equity portfolio. Our research suggests each year tax naivety could cost a fund (ignoring fees and transaction costs) around 25-30 basis points in after-tax returns for a cap-weighted index portfolio and 64-86 basis points for factor-based equity portfolios.

In research published in December 2019, we again tested these tax efficiency principles on a hypothetical international equity portfolio tracking a RAFITM, or “fundamental indexing”, benchmark over January 1997-December 2018. True to expectation, the after-tax performance payoff for a super fund portfolio was 53 basis points annually.

To be clear, these represent portfolios with very similar risk and pre-tax return properties to their tax-naive passive counterparts, but with an eye to improving the tax efficiency of the portfolio as well. A consistent insight in our research, verified in our live experience managing portfolios for super funds, is the ease with which a genuine after-tax focus can be applied to perhaps any way of obtaining listed equity exposure.

For super funds moving to passive or rules-based equity approaches, or considering a change in who they partner with for their rules-based equity solutions, there is now a way to build a “better kind of passive” equity exposure; one which harnesses an additional source of returns, helps funds with their compliance obligations to be after-tax focused and aligns with the after-tax world of fund members.

Raewyn Williams, managing director, research (Australia) and Josh McKenzie, analyst at Parametric

Parametric Portfolio Associates® LLC (“Parametric”), headquartered in Seattle, Washington, is registered with the US Securities and Exchange Commission (“SEC”) as an investment adviser under the US Investment Advisers Act of 1940. Parametric is exempt from the requirement to hold an Australian financial services license under the Australian Corporations Act 2001 (Cth) in respect of the provision of financial services to wholesale clients as defined in the Corporations Act and the Australian Securities and Investments Commission’s Class Order 03/1100. SEC rules and regulations may differ from Australian law. Parametric is not a licensed tax agent or adviser in Australia and this does not represent tax advice. This material is intended for wholesale use only and is not intended for distribution to, nor should it be relied upon, by retail clients.