As interest rates have dropped over the last decade on government bonds, corporate bonds and term deposits, a new era has begun in which the outlook points to low interest rates persisting for longer. Australians are therefore seeking alternatives to traditional income assets and have moved up the risk curve to pursue greater yield. Part of this journey includes emerging markets bonds. Generally, emerging market economies are more structurally sound with lower levels of debt than they’ve had in the past. Current accounts and government budgets are largely in check. Policymakers, appealing to ever-growing and better educated middle classes, are encouraging savings and pension reforms which are driving capital investment. Today, the new world of emerging markets debt is characterised by higher foreign exchange reserves and lower spreads on government bonds.

This contrasts with the “old world”, where two decades ago, emerging markets bonds were risky and volatile due to low reserves of foreign currency, high levels of government debt and inflated asset values. This was typified by the 1997 Asian financial crisis and the 1998 Russian financial crisis then Argentina’s much-publicised default in 2001. These crises set the scene for significant economic and structural reforms in the new millennium. Today, while the US, Australian and many European economies are drowning under the weight of high levels of government and/or private sector debt, many emerging nations have low debt levels or are net savers, lending money to developed nations rather than the other way around. Emerging nations are paving the path to higher incomes for investors.

Returns worth seeking

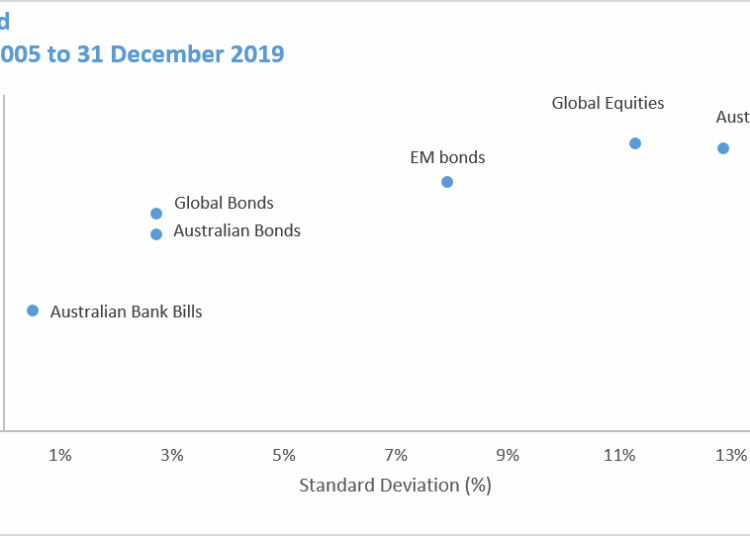

Reflecting their appeal, emerging markets bonds have produced positive returns in 14 of the last 15 years to 2019 and have provided a commensurate risk/return trade-off compared to other asset classes. Returns have averaged 7.4 per cent per annum, as the chart below shows, more than double that of global and Australian bonds, while risk levels remain well below those of Australian or global equities. This is an important opportunity for investors to derive income, without chasing dividends from much riskier equity markets.

Source: Morningstar Direct. Results are calculated monthly and assume immediate reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used Australian bank bills – Bloomberg Australian Bank Bill 0+ Yr Index, global bonds – Barclays Global Aggregate Bond Index A$ Hedged, Australian bonds – Bloomberg AusBond Composite 0+ Yr Index, EM bonds – 50 per cent JPM EMBI Global Diversified and 50 per cent JPM GBI-EM Global Diversified – this composite index is used to illustrate historical performance of the EM Bond market only. It is not the benchmark for EBND, Australian equities – S&P/ASX 200, Global equities – MSCI World ex Australia Index, EM equities – MSCI Emerging Markets Index.

Opportunity in diversity

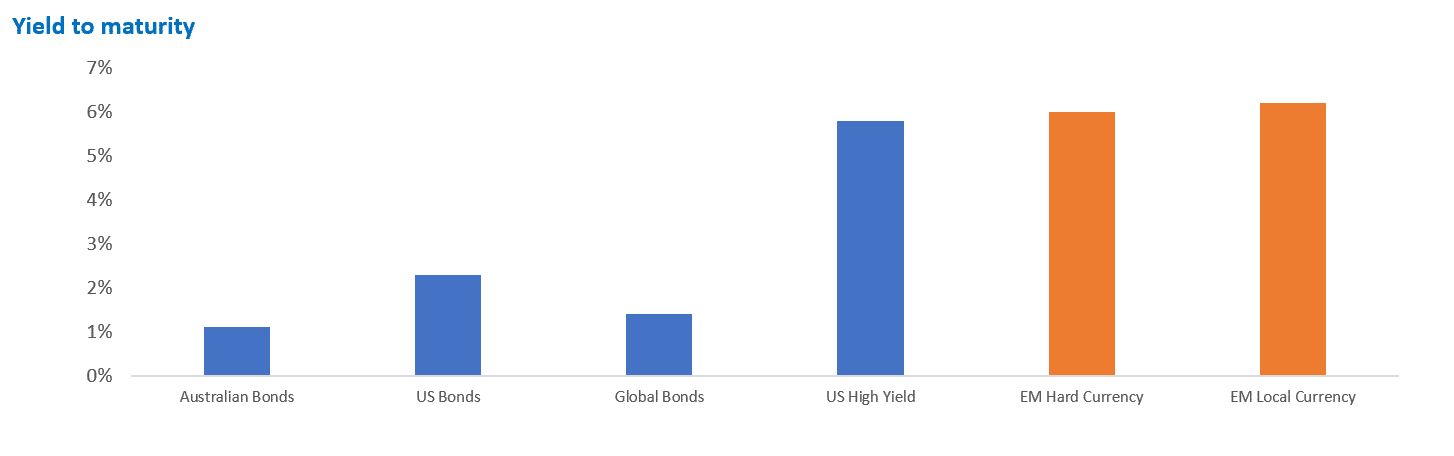

The emerging markets debt pool is large and significant for its varied offering. Emerging markets debt is comprised of four key segments: 1) hard currency sovereign bonds, which are issued by governments, usually in US dollars. The yield is typically the US Treasury yield plus a spread to compensate for the additional risk of investing in emerging markets; 2) local currency sovereign bonds are issued by governments in their own currency. This is the largest segment of emerging market debt so it is the most liquid. Investors can also take advantage of the returns from currency movements; 3) hard currency corporate bonds are issued by companies within emerging markets, usually in US dollars. There are many issuers which allows for diversification by sector, country and security; and 4) local currency corporate bonds are issued by companies within emerging markets in their own currency. Emerging market governments and corporations generally pay more on their bonds than their developed market counterparts, as the chart below shows.

Source: Bloomberg. Data as at 31 December 2019. Data is in Australian dollars. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the indices or EBND. Indices used: Australian bonds – Bloomberg AusBond Composite 0+ Yr Index, US bonds – Bloomberg Barclays U.S. Aggregate Total Return Index Unhedged AUD, global bonds – Bloomberg Barclays Global-Aggregate Total Return Index Value Unhedged AUD, US high yield – ICE BofAML US High Yield Index, EM hard currency – J.P Morgan Emerging Markets Bond Index (EMBI) Global Diversified, EM local currency – J.P. Morgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM). EMBI is unhedged. EBND will hedge its hard currency.

We expect this premium in emerging markets bonds to continue given the structurally sound characteristics of many emerging market economies. We believe this presents an opportunity for investors to look beyond the past and move into emerging markets debt securities to fill out the income part of their portfolios.

Active management for emerging market bonds

We believe an optimal portfolio of emerging markets bonds is unconstrained by indices, and invests in bonds that offer the best value relative to their fundamentals while managing risk. Investors can now more easily access emerging markets assets with exchange-traded funds on ASX. The VanEck Emerging Income Opportunities Active ETF (Managed Fund) (ASX: EBND) enables investors to access a diversified portfolio of emerging markets bonds via a single trade on ASX.

Arian Neiron, managing director – head of Asia Pacific, VanEck

Disclaimer: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 as the responsible entity of the VanEck Emerging Income Opportunities Active ETF (Managed Fund) (“EBND”). This is general information only about a financial product and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. EBND invests in emerging markets which have specific and heightened risks that are in addition to the typical risks associated with investing in the Australian bond market. Before making an investment decision, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from EBND.