Climate-related risks (and opportunities) all carry a large degree of uncertainty about them that can make investors and investment managers uncomfortable. However, they are not dissimilar to other unknowns, which investment managers take a view on and incorporate into their overall company analysis. Below we explore different types of climate change risks and their possible impact on investments in the absence of market-wide disclosure. These risks can be grouped into two pillars: physical and transition. The following will provide a guide to understanding these climate-related risks and their potential impact on investments.

Physical risks

Physical risks relate to changes in the frequency and severity of extreme weather events such as heatwaves, flooding, drought, cyclones as well as longer term impacts such as coastal inundation and changes in precipitation patterns, which can have disruptive effects on property, tourism and trade.

For long-term investors such as superannuation funds and those investing in real assets, physical risks pose a significant challenge. Acute and chronic effects of a changing climate can lead to reduced revenue from decreased production capacity (e.g. supply chain interruptions), negative impacts on workforce (e.g. absenteeism), write-offs and early retirement of existing assets (e.g. damage to property and assets), increased operating costs, increased capital costs, reduced revenues from lower sales/output, increased insurance premiums and potential for reduced availability of insurance on assets in “high-risk” locations.

In addition, there are second-order effects, particularly on the tourism industry, with increasing duration and intensity of heatwaves and bushfires as well as effects on wildlife such as beach closures resulting from the expanding distribution of deadly jellyfish along Queensland’s coast leading holidaymakers to stay away from affected areas. Changes to rainfall patterns are projected to increase both flooding and drought in different parts of the world, with escalating impacts for economic sectors including agriculture.

Transition risks

Transition risks and opportunities are likely to be the biggest area of focus for equity and bond portfolio managers investing with shorter time horizons.

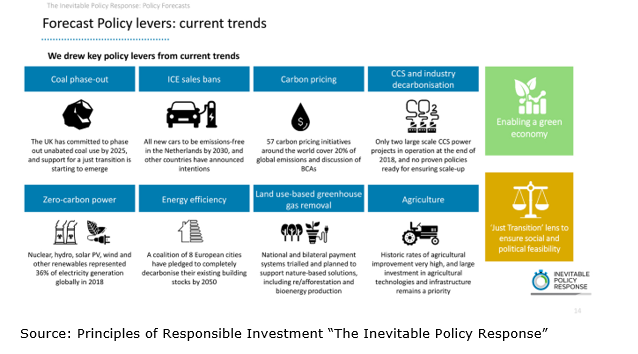

These risks include increasing climate change regulation & policy, technological advances and changes in consumer preferences relating to a global transition to a low-carbon economy. The timing, content and speed of such a transition carry a large amount of uncertainty and will require portfolio managers to take a view on how that will play out.

Transition risks can be broadly grouped onto five categories.

Policy risks associated with a transition to a low-carbon economy include the introduction of a carbon price (both within Australia and globally, which may affect demand for exports), compulsory carbon risk disclosure by listed companies and associated revaluation risks as well as mandates on and regulation of existing products and services. These can lead to increased operating costs (e.g. higher compliance costs, increased insurance premiums), write-offs, asset impairment, and early retirement of existing assets due to policy changes.

Technological risks (and opportunities) include technological advances enabling cheaper and more accessible renewable or low emissions options leading to the substitution of existing products and services. Consideration must also be given to the costs of transitioning to lower emissions technology for companies and the write-offs or early retirement of existing assets.

Market risks are largely driven by changing consumer preferences leading to declining demand for goods and services. Increased costs of raw materials can also result in increased production costs due to the higher price of inputs (e.g. energy, water) and outputs (e.g. waste management). There is also the risk of asset repricing such as fossil fuel reserves, land and securities valuations.

There are also reputational risks which may affect a company or an entire sector. This can result in reduced revenues from reduced capital availability, demand for products or services or disruption to the supply chain.

Liability risks are associated with the increasing scope of climate change litigation against individuals or entities who do not take sufficient action to adequately protect or assess assets and investments in the context of losses or damages resulting from climate change. These entities and individuals are likely to experience both financial (in the form of compensation payments) and reputational damage from such litigation. In the Memorandum of Opinion published by the Centre for Policy Development in 2016 the authors expressed the view that “company directors who fail to consider climate change risks now could be found liable for breaching their duty of care and diligence in the future” and considered that “a negligence allegation against a director who had ignored climate risks was likely to be only a matter of time”.

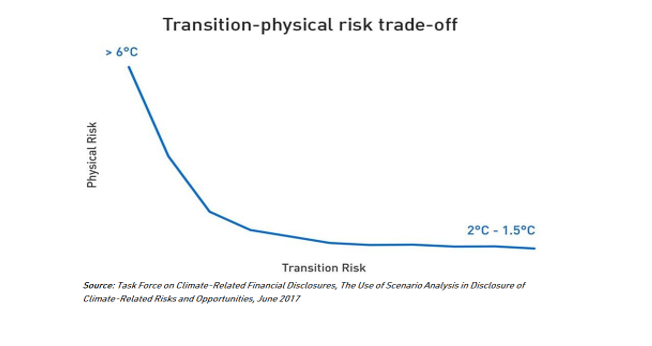

The trade-off between physical and transition risk will be largely determined by the speed and magnitude of the global policy response, as illustrated in the below chart. A fast response with aggressive mitigation policies would reduce physical risks but significantly increase transition risks for businesses. A slow policy response would mean more greenhouse gases released into the atmosphere resulting in higher physical risks with a smoother transition to a low-carbon economy. An even worse scenario would be a delayed response that required an aggressive policy response down the line, hiking up both physical and transition risks to the maximum.

Climate change opportunities

Opportunities arise out of companies that develop technologies or solutions to deal with the physical aspects of climate change as well as those companies that are better prepared and less exposed to the negative effects of a transition to a low-carbon economy. There is huge potential for returns through climate change in this context for investors who back the right companies.

Over the last five years we have seen a shift in thinking by economists, investors and regulators around the financial materiality of climate change risks on companies and financial markets. As these risks and opportunities continue to materialise there will be an increasing expectation on investment managers to demonstrate how they are considering these factors within their investment processes. With this area of fundamental analysis still developing there exists an opportunity to develop innovative approaches to assessing and measuring such risks. For the asset managers who get there first this could present a real opportunity to meet increasing asset owner demand for climate risk incorporation.

Agnieszka Cochrane, ESG specialist, Fidante Partners