US markets have sold off sharply after reaching record highs, driven by a correction in large‑cap technology stocks. With equity markets showing resilience throughout the summer, investors have raised concerns about market valuations, with some believing equities are priced for perfection. Given the weakness has centered on the FAANG complex, we address whether the recent market sell‑off implies the end of growth leadership.

This is not the beginning of the end for growth

We do not believe recent volatility implies the bursting of an equity or, specifically, a growth equity bubble. However, we are seeing a rebalancing of crowding in some of the most high‑performing growth stocks that have driven this stock market rally in recent months.

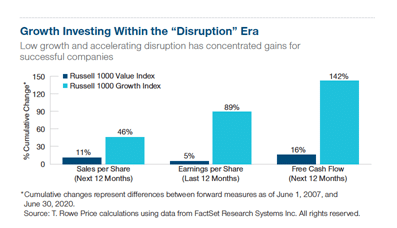

In late spring/early summer, the market began to recognise what we had positioned for early in the crisis – that certain companies would see their economic futures pulled forward by the coronavirus crisis. These were mainly in the growth complex of the opportunity set. This led to the unusual outcome that growth stocks showed market leadership before, during, and after a market crisis, albeit supported by greatly superior sales, earnings, and cash flow characteristics (see chart).

The bifurcation of economic returns stems from several factors, but central is the era we live in where capacity has continued to be unlocked, fueled by monetary stimulus, and enabled by a new era of technology. The dulling down of the “normal” growth and inflation cycle and the advent of being able to monetise technological innovation have also created an unusual backdrop.

Massive monetary and fiscal stimulus and the “stop getting worse” phase have encouraged flows into risk assets, and especially into certain growth stocks. The direction of the flows will have been enhanced by the growth of passive investing (dovetailing with the largest index concentration seen in US equities since 1999) as well as factor‑driven investing pouring money into “momentum” and “growth” characteristics. This is unhelpful in terms of market breadth and for fundamental investors in many senses, but it’s a backdrop we’ve seen and managed before.

Valuations needed attention

Broad‑based valuations are not extreme, but in certain areas they had reached expensive levels. While there are good reasons underlying the multiple expansion since equity markets troughed in late March, we have been very conscious of the need to manage the valuation element of the risk equation. Over the last few months, we have evolved the strategy in aggregate but also on a stock‑by‑stock basis through the crisis and subsequently through the rerating stage of the market rally during the summer.

This has led to reduction in positions in many of the outright winners from the coronavirus pandemic, specifically where valuations had expanded to create risk. We believe that companies like Amazon are still under‑monetising their business models given recent investment programs (including investments aimed at increasing the sustainability of their businesses). We continue to favor Apple given the new product cycle ahead.*

The team and I remain comfortable with our exposure to the FAANG component of the strategy, given the position sizes set against the thesis that sits behind each stock. In aggregate, our FAANG overweight position is as small as it has ever been under my near eight‑year tenure. We would highlight that for the strategy, the FAANGs have not been the majority driver of outperformance we have delivered this year. Stock‑picking success has been very broad and come largely from stocks outside the mega‑cap US information technology sector.

Throughout the summer, we have rotated the strategy to manage the valuation risks that have evolved. We took profits in many cases and reinvested in high‑quality stocks, especially in cyclical areas where we have identified product and innovation‑driven cycles that should see accelerating economic returns.

This is not a call for value to “work,” given the underlying economic cycle is still being defined by low growth and low inflation, but rather a set of stock‑specific decisions to invest in stocks that help both our return outlook and our portfolio risk characteristics. We have increased exposure to certain names in India, Europe, and Japan, while maintaining an underweight in US equities.

Dispersion and breadth to return

We see the current market sell‑off as healthy and perhaps somewhat normal given the resilience of equity markets in recent weeks. In an ideal world, we’ll see a degree of dispersion and breadth come back to equity markets as a result of the shakeout, given that periods of volatility tend to sift out some of the factor‑driven capital, especially capital anchored around presumed backward and short‑term measures of “risk.”

We feel comfortable with our medium‑term outlook for the global economy, corporate profits, and especially the path of improvement for the stocks we own. We have needed to work hard and adapt through this highly unusual year, always aiming to be carefully contrarian. We reduced balance sheet risks in the early stages of the crisis, while simultaneously recycling into what we believe were attractively valued secular winners around the peak of volatility and fear.

As noted previously, we have also rotated into high‑quality select cyclicals in the recovery phase, as crowding in certain growth segments has become a reality of markets. These demonstrate some of the individual and collective hard choices that we have made for our clients as the market and economic backdrop has changed rapidly.

We continue to believe in the power of change, driven by periods of crisis, and we are thinking deeply about the world post the coronavirus and what it may mean for markets and investors. As growth investors, we need to be vigilant about extreme conditions but always putting our clients on the right side of change.

David Eiswert, portfolio manager, global focused equity strategy, T. Rowe Price

*as of 31 August 2020