But there’s a more basic question: “What is an adequate pension?” Now, with the final report of the Retirement Income Review (RIR) in the public domain, answers to both questions should be more forthcoming – and in the right order.

Hopefully this long-awaited report will help motivate superannuation funds to move from thought to action in devising retirement solutions for their members. With compulsory superannuation approaching its 30th birthday in 2022, intelligent glide paths into and through retirement will be a hallmark of the system’s “coming of age”.

In tackling this issue, super funds have the chance to break the mould. They are not shackled by legacy products; neither are their pension solutions the focus of peer surveys, the APRA heatmap or the controversial proposed performance benchmarking rules. Retirement product design is a rich greenfield-type opportunity to get back to the specific needs of fund members and embrace problems not yet solved by the industry – truly, a licence to innovate.

A fund’s answer to the question, “What is an adequate pension?” is in part revealed by the benchmark it adopts to measure the success of its income-targeting strategies. Let’s illustrate this in the context of a super fund equity portfolio designed to deliver an adequate level of income (yield) to the fund’s pension members. Of course, multiple asset classes (not just equities) will be used in a fund’s real-world retirement solutions.

An obvious benchmark for this equity income portfolio would be the yield of the S&P/ASX 200 Index. If adopted, franking credits should be added to the equation because they can provide significant value to retirees. We suspect this market-cap benchmark approach to yield will appeal to many funds, being relatively easy to implement, reflecting familiar performance and benchmark concepts and showcasing how a fund’s portfolio design and manager selection can beat a “dumb beta” equity portfolio yield outcome.

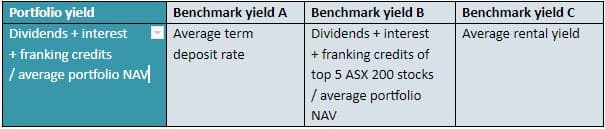

But this benchmark approach has drawbacks – it measures yield “success” via the prism of the fund, not the member. It also clashes with the RIR’s observation that what is an “adequate” pension is inherently subjective and will vary from member to member. A way for a super fund to close this agency gap is to use data and assumptions about members to establish appropriate “counter-factuals” – where these members would have otherwise invested. To explain: imagine that the fund is able to establish member cohorts for three counter-factual scenarios – terms deposits, five blue-chip Australian companies or a rental property – justifying measuring retirement portfolio yield success as follows:

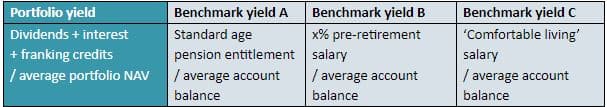

Another way to answer whether a pension is “adequate” could get even closer to what success means to a retiree. Below, benchmark A best captures the government’s proposed legislated objective of super to “substitute or supplement the age pension in retirement” (which might also satisfy the RIR’s favoured objective of the retirement system if the pension is viewed as securing a minimum living standard consistent with prevailing community standards); benchmark B – the RIR’s preference – is the most personal, aiming to provide a sufficient salary replacement for the retired member; while benchmark C was identified by the RIR as very aspirational, based on the published ASFA comfortable living standard dollar figure.

Our key message to super funds as they develop and implement their retirement portfolios is this: the RIR’s report adds impetus to the merits of thinking outside the square. Simply migrating mechanical accumulation portfolio-style yield benchmarks will often miss the mark for members, and seems to fall well short of the RIR’s idea of good, member-centric retirement product design. Buoyed by the RIR’s important work, it is time now for funds to think innovatively and define yield success in a way that more closely reflects what retired fund members relate to and care about. The estimated 1.8 million members moving into and through retirement in the next five years stand, immediately, to benefit if funds can rise to this challenge.

Raewyn Williams, managing director, research Australia – Parametric Portfolio Associates LLC

Source of data: Parametric Portfolio Associates LLC as at 30 November 2020

This information is intended solely to report on investment strategies and opportunities identified by Parametric. Opinions and estimates offered constitute our judgement and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors.