One area we believe is still not well understood by many investors, but which can offer much-needed stable income, is private credit.

Private credit funds as a stable income generator

Private credit funds earn an income for their investors by lending in one form or another to consumers and corporates. An increasingly fertile opportunity for private credit funds is investing into the receivables funding requirements of the rapidly growing non-bank lending sector.

Non-bank lenders are organisations that lend out funds with a margin for profit. They do not take deposits but rather raise money from private credit funds, banks and other investors.

The non-bank lending sector is experiencing rapid growth, as the new fintech enabled lenders, such as the ASX-listed MoneyMe, Plenti and Zip to name a few, are able to meet the borrower needs the traditional banks are unwilling, or unable, to provide.

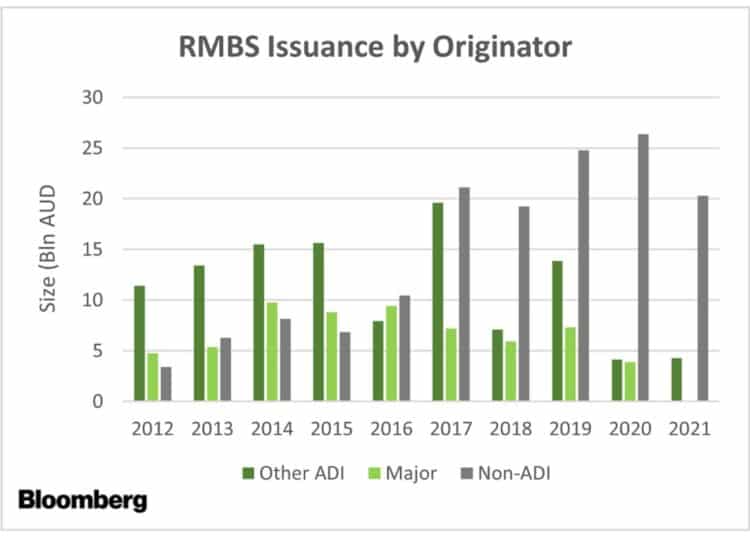

One good example is residential mortgage-backed securities (RMBS) that are a debt-based security backed by the interest paid on residential loans.

The chart below shows the strong growth in residential mortgage securitisation issuance of non-authorised deposit-taking institutions since 2016. This growth has continued through to 30 June 2021.

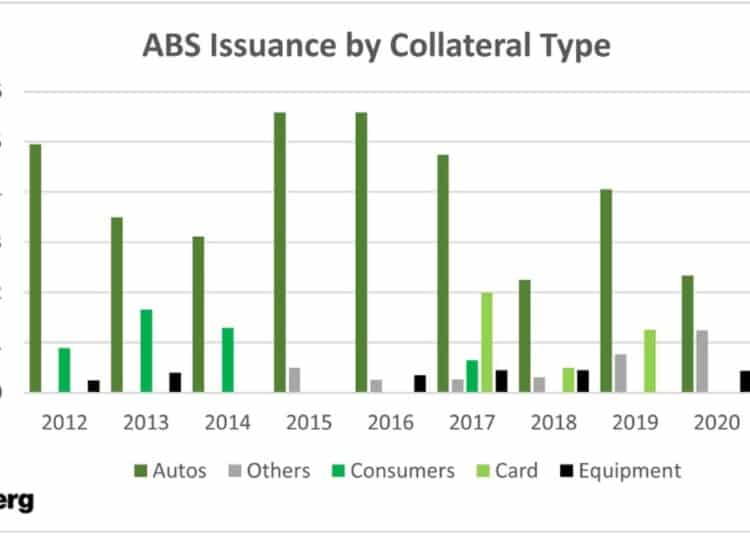

There are also non-bank lenders in asset leasing/finance, SME loans and specialised niches such as medical professionals and strata funders that are also experiencing significant growth.

The chart below shows the strong growth of “other” asset-backed security securitisation issuance since 2018, which has also continued through to 30 June 2021.

Non-bank lenders have not been untouched by COVID-19. Many of the underlying borrowers funded by non-bank lenders did experience stress during the height of the pandemic and in some cases required capital and/or interest payments on their loans to be deferred.

But the Australian government has provided good support for both the bank and non-bank lending markets, with $2.3 billion advanced to the sector via the Structured Finance Support Fund, administered by the Australian Office of Financial Management, to ensure the wholesale funding markets for non-bank lenders remained open through the tough COVID-19 lockdown times of 2020. The SME guarantee schemes also provided significant support to the sector – the second scheme guarantees 50 per cent of the risk on eligible loans originated by eligible lenders from 1 October 2020 to 30 June 2021.

Private credit funds and non-bank lenders – a virtuous circle

Growth in the depth and breadth of the non-bank lending market has created attractive investment opportunities for private credit funds that provide funding to non-bank lenders. Private credit funds are also experiencing strong growth as investors seek the income yield they provide.

Returns generated by private credit funds providing funding to non-bank lenders can vary from 3 per cent over the RBA cash rate to in excess of 10 per cent, depending on the risk profile of the underlying assets and funding structure. These returns compare very favourably to those available on other traditional income generators in portfolios – term deposits, AREITs and hybrids.

Our fund, for instance, focuses on lending to niche non-bank lenders, which we believe can provide a differentiated risk/return profile for our clients. For example, we provide funding to a non-bank lender in the medical professional sector where doctors and dentists have high incomes and a strong propensity to repay their debts. It is also a sector that is relatively unaffected by COVID-19 and lockdowns, as most dentists and doctors have been able to adapt their practices to the lockdown economy. The management and shareholders of the business have been involved with the sector for many years and have an extensive relevant track record.

Risks and how to assess them

The process we follow to analyse identifying credit risk is the back to basics approach of the “5 Cs” – character, cash flow, capital, collateral and conditions. This approach isn’t unique to us, but it is a common-sense approach that is useful to the evaluation of credit risk that has remained relevant through many cycles.

When considering providing funding to non-bank lenders, it is important to ensure that they are appropriately applying the 5Cs to their borrower pool in a way we are comfortable with and we use the 5Cs to assess the business of the non-bank lender as sponsor of the receivables pool we are funding.

Character refers to reputation. Is the borrower trustworthy? Have they always been trustworthy or do they have a mixed reputation? In our case, we don’t just consider the character and reputation of the non-bank lender but also their shareholders.

Cash flow (also sometimes referred to as capability to repay the loan) is all about the financial position of the borrower and how well placed they are to continue making payments into the future. A whole of balance sheet approach is required here to consider, not just an organisation’s current and expected cash flow, but also any other debts they may have.

When character and cash flow are applied to funding non-bank lenders, they also need to be applied to the underwriting guidelines the non-bank lenders use to make loans to their clients.

Capital refers to the purpose of the borrowing and how much of their own money a borrower is willing to invest. In the simple example of a home loan, a borrower is likely to find it easier to get a loan if they have a substantial deposit as it is a sign of their capability to raise (save) funds in the first place.

Collateral is the security offered by the borrower for the loan. Loans with collateral – such as a house for a mortgage – are referred to as secured loans. Any unsecured lending needs to be short-term and only to high-quality borrowers. Collateral is important, as it offers lenders an important recourse, but should never be the only factor when considering credit risk as a borrower even with collateral, but no cash flow, cannot repay a loan.

The end result – stable income for investors

There is no doubt the rapid growth in the non-bank lender market is providing ample opportunity for private credit funds to generate a stable income yield for investors and improve the diversification of sources of return in portfolios. That makes private credit funds an increasingly attractive allocation for the yield components of portfolios. However, a rigorous two-tier risk assessment process needs to be followed – both by the non-bank lender in the origination of its loan and the private credit fund – in the selection of a suitable non-bank lender.

Rob Hamer, portfolio manager, Wentworth Williamson