It is during volatile market periods like these that it is more important than ever to not panic, to stick to a sound investing strategy, focus on a few key investment metrics and ride out the waves.

When it comes to equity markets, it is important to look beyond the traditional accounting-based metrics of price to earnings ratios and price to book ratios. A better approach is focusing on investing in those companies with sound capital allocation practices and policies.

Measuring the measurable

According to John Tobin, portfolio manager at Epoch Investment Partners, a good example of sound capital allocation is how well a company generates – and allocates – free cash flow. He says the growth of free cash flow of a company is the best predictor of long-term shareholder return.

Free cash flow refers to the amount of cash a company has left over after paying for all its operating expenses and capital expenditure. It can be even more reliable than reported earnings, especially if a company may appear to be generating reported earnings but not cash flows. It weeds out the companies actually making money, from those that are just promising to do so.

So how is free cash flow measured? There are two measures to determine if a company is generating free cash flow and by how much it is growing.

The first measure looks at free cash flow over the past five fiscal years to provide a historical view and to smooth out short-term fluctuations. It also highlights whether or not a company has grown its free cash flow.

The second measure uses broker estimates of free cash flow for the next fiscal year to provide a forward-looking view.

Looking ahead

Current market volatility is chiefly a result of expectations that interest rates are about to start rising dramatically in the US and across the globe. Inflation is increasing and the natural policy response is to raise interest rates, despite other underlying issues, such as slow economic growth.

Epoch is forecasting US rate rises of between 50 to 60 basis points, which will obviously translate to higher bond yields. As Warren Buffett once famously said: “when the tide goes out – aka interest rates rise – you can see who is swimming naked”. So weak links will crack during a tightening phase of a Fed cycle with assets like cryptocurrencies, NFTs and special purpose acquisition companies (SPACs or holding companies) to be the obvious weak links.

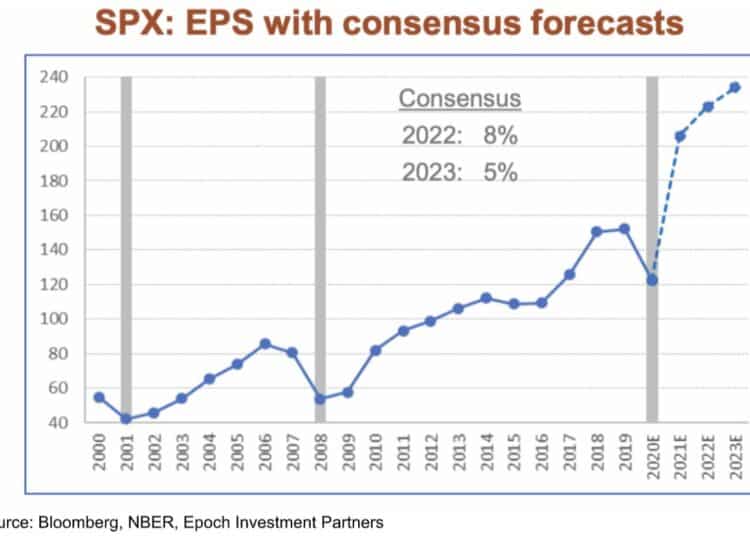

But this does not mean free cash flow will disappear. Epoch’s free cash flow forecasts for the S&P 500 for the next two years are 8 per cent per annum in 2022 and 5 per cent per annum in 2023.

Free cash flow growth will not be consistent across the board, with growth in industries that have been hit particularly hard by supply chain issues and higher labour and other fixed costs, to be slower.

The right stuff

In such an environment it is important to invest in the right kinds of companies. To do so, investors need to scrutinise balance sheets to determine whether businesses have management that can allocate capital wisely in order to have strong free cash flow going into the future.

A key measure to examine is whether or not companies have a demonstrated ability to deliver a return on invested capital above their weighted average cost of capital (WACC). Also, companies which have the ability to differentiate their products, and create and protect these products with patents and brand identity, are more likely to be able to deliver free cash flow. These kinds of companies tend to be in the technology, healthcare and consumer products sectors, and are less likely to be found in sectors such as energy, materials or utilities, where it is harder for companies to stand out.

Any company that is going to survive in the current environment also needs a business strategy for the digital age. Such companies may come at a high valuation, which means understanding the impact that rising interest rates have on anticipated free cash flow rates is vital.

But tools of digitisation, such as digital platforms, also feature low marginal costs and increasing returns to scale. In the long run, these will ultimately improve free cash flow margins and facilitate higher return on equity for the astute investor.

One example of a high-quality company that grows and pays a dividend is insurance company Metlife. The company has strong revenues at $68 billion which allows the management of Metlife to reward its shareholders with an attractive growing dividend, debt reduction, and share repurchases. And its cash flows are sustained by its wide offering across geographies, along with being a well-recognised brand.

Another example of a company that pays a consistent and growing dividend is network provider Cisco Systems. Cisco’s cash flows are driven by a combination of network upgrades, expansions, product refreshes, and recurring services. Cisco uses its free cash flow for R&D and M&A, and it has an ongoing share purchase program, along with a strong brand.

With above-trend global economic growth in several regions likely to persist for the next couple of years as economies continue to reopen and inflation pressures build more substantially, the outlook for cash flow generation and shareholder distributions will continue to be positive.

Damien McIntyre, CEO at GSFM.