Below, we discuss the continued tailwinds for the sector and why we expect it to continue to add fuel to the performance fire for value for some time.

Energy on the rebound

Returns for the Australian energy sector since 2020 had reflecting weakness in the oil price, driven by a material drop in global demand as economic growth slowed and international travel came to a grinding halt.

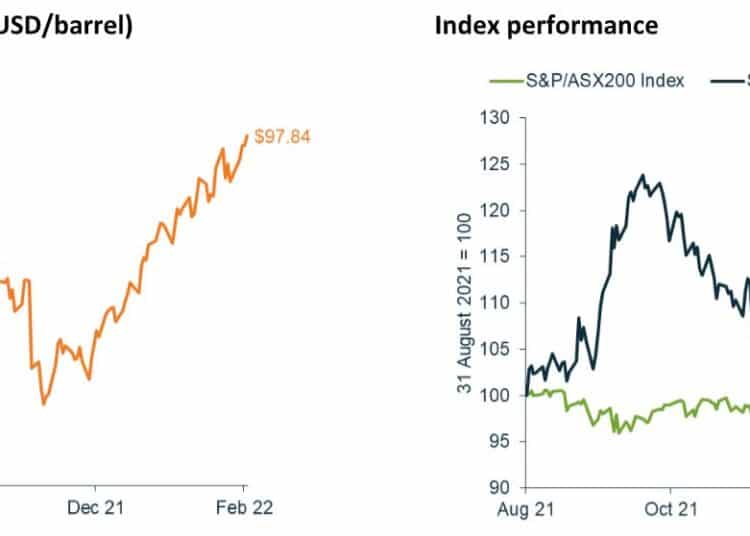

This trend has started to show signs of sharp reversal, with the sector having outperformed the S&P/ASX 200 Accumulation Index by 25 per cent since its index-relative low in August 2021, and the global price of oil also rising at a rapid pace.

The energy thematic tailwind, and our significant overweight allocation to energy, has added significant alpha (net of fees) to our Martin Currie Select Opportunities Fund since the sector’s August 2021 low.

Drivers behind the recent strength

The energy sector is highly correlated with the pace of economic expansion, as production and growth are typically associated with higher consumption of energy and base commodities.

Global COVID-19 restrictions have continued to ease, and economic data points to clear strength in the pace of economic reopening across major economies. The data suggest strong momentum behind the recovery which will likely persist for some time.

The oil price has also been particularly strong so far through 2022 as the reflation thesis has continued to gain traction. Brent Crude is up 25.8 per cent for the year-to-date; the notable strength can be attributed to several factors:

– Strengthening demand for oil on the back of solid industrial production expectations as global economic reopening gathers momentum.

– Weaker supply with many OPEC+ countries (and Russia) missing agreed output targets in conjunction with declining inventories.

– Accelerating pressure to decommission coal-based power generation plants to drive carbon reduction means supply-side investment is lagging the required replacement rate.

– Geopolitical risk premiums having an impact – e.g. the current tensions between Russia and Ukraine.

– Colder than normal weather conditions in the Northern Hemisphere in particular, resulting in higher gas prices, which have subsequently placed upward pressure on the price of oil due to fuel switching by consumers.

Why tailwinds for the sector remain

Even considering the strength so far this year, we believe that there will be continued tailwinds for the sector over the short to medium term.

While we are not in the business of calling a price target on highly volatile commodities, we have conviction in our view that pricing can remain above “normal” in the current environment. Inventory levels are low across the spectrum of energy commodities – gasoline and diesel are well below normal, so even if more oil was to come into supply, there will be a significant restocking event required to move back to normalised supply levels.

Compounding the impact of supply shortages is the accelerating push to decarbonise the energy supply chain, specifically seeking to replace traditional coal-fired power generation plants to reduce carbon emissions. Increasing market and community pressures mean that current investment levels in coal-fired power generation are insufficient to meet growing energy requirements, contributing to ESG-driven inflation in power pricing as prices are adjusted upward. While the ultimate goal is clearly to achieve complete production from renewable sources, we see meaningful upside from gas as a key transition fuel to a greener future, in particular, given its lower carbon intensity relative to coal.

Energy is an important part of the total value chain. Given its underlying linkage with increasing inflation, as well as a lack of global investment in supply as noted above and continuing geopolitical tensions, the current deficit will not be easily filled. In combination with the strength of global demand, fuelled by economic recovery and strengthening industrial production, this supply deficit will continue to support higher prices for energy commodities and energy related stocks over the short to medium term.

A key overweight for our value portfolios

The Martin Currie Select Opportunities Fund maintains a high conviction overweight exposure to the energy sector, with a portfolio allocation of 12 per cent, an 8 per cent overweight relative to the S&P/ASX 200 Index.

Our portfolio overweight to the energy sector is implemented through high conviction overweight allocations to high-quality stocks such as oil and gas producer Woodside Petroleum and global engineering company Worley.

We see meaningful valuation upside in each of these stocks, as well as notable leverage to the future decarbonisation pipeline for the energy sector going forward. Not all energy stocks are created equal, and we see more supply and demand tailwinds for natural gas producers than coal and oil players due to their important participation in the carbon transition toward net zero.

Reece Birtles, chief investment officer at Martin Currie Australia.