In this piece, we will explain the relationship between the USD and Emerging Markets (EM) equities.

The USD-EM relationship

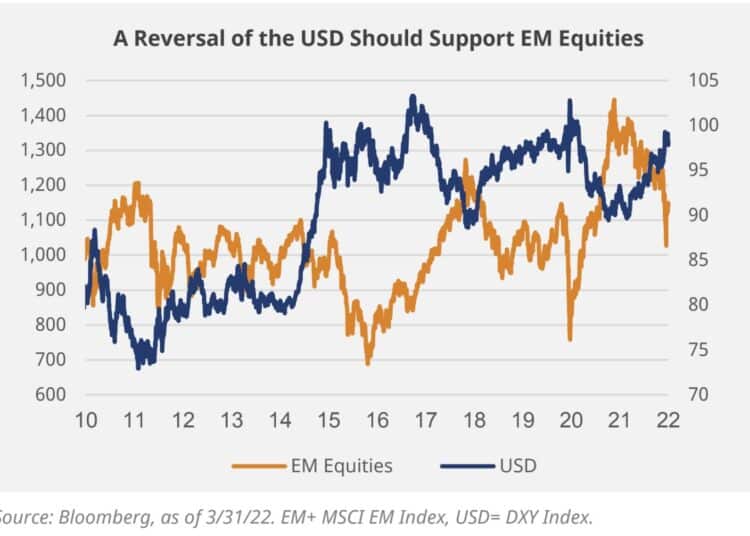

Historically, EM equities have shown a negative correlation with the dollar and have gained roughly 4 per cent for each 1 per cent of USD weakness. A strong USD translates into potentially weaker EM performance, as EM countries and the companies within them generally leverage themselves in USD-denominated debt. Therefore, a stronger USD leads to larger balance sheet liabilities and negative earnings revisions as net interest expenses increase.

Additionally, a stronger USD is normally negative for commodity prices, as they are priced in dollars, which further hurts commodity exporting countries. Note that we are not seeing that relationship this year due to the supply disruption from Eastern Europe.

It’s also important to point out that a strong USD can create challenges for China. Though export-based manufacturers are likely to benefit, one should also keep in mind that Renminbi weakness against the USD, in combination with low Chinese bond yields, translates into capital outflows from China. Outflows can lead to lower GDP growth, and this can spill over into other EM countries since China represents a significant portion of demand for EM goods.

In and around fed rate hiking cycles

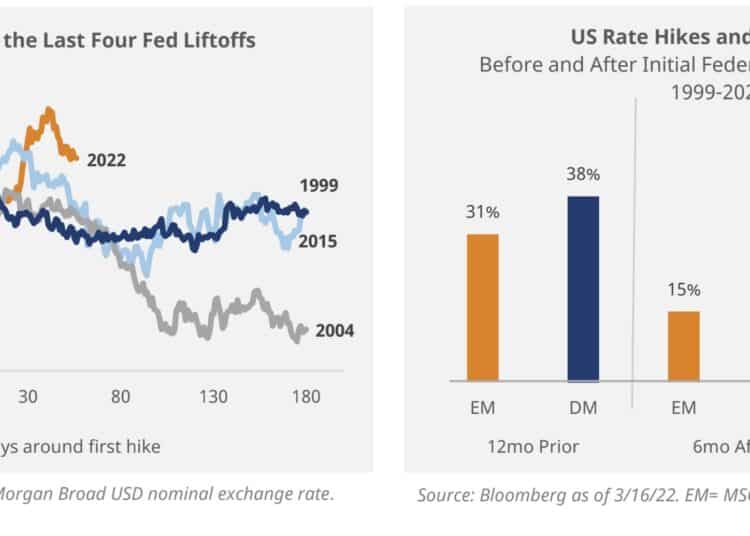

On the positive side, looking back at the past four US interest rate hiking cycles, we note that the USD has strengthened in the beginning of the hiking period but soon weakened following each cycle’s initiation. This is due to the market pricing in higher rates, which inherently slows down economic growth, and eventually puts the brakes on central bank activity.

If US inflation reaches its peak and the country’s economic activity begins to slow down, this could bode negatively for USD strength and create a positive catalyst for EM assets. Looking back at data between 1999 and 2022, EM equities have outperformed, on average, by 11 per cent and 10 per cent, respectively, the following 6 and 12 months following initial Fed rate hikes.

Finding Peaks

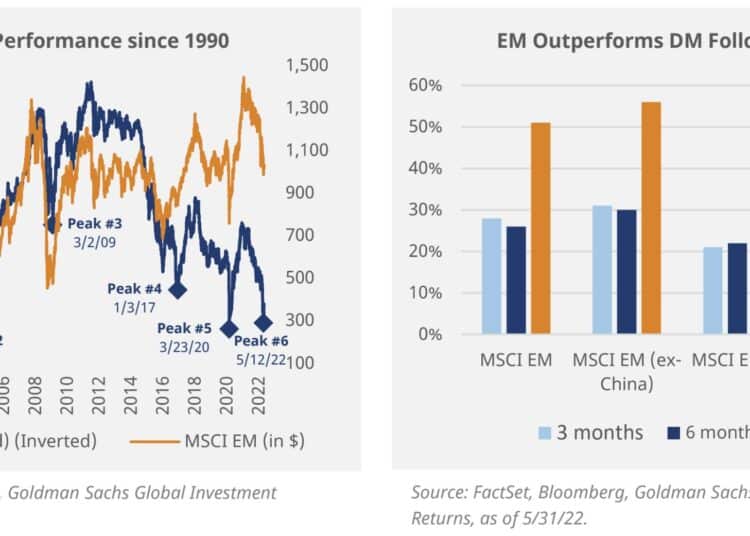

It is also important and complimentary to note that growth differentials often act as a key driver for EM currency strength (compared to the USD). Thus, increasing EM growth relative to the US could signal a peak in USD strength. This is due to (1) the connection between higher US interest rates leading to a stronger dollar but lower growth, and (2) capital allocators looking for investments with growth potential.

Hence, as seen below, a peak in the USD has historically translated into EM equities outperforming Developed Market (DM) peers over the following 12-month period. Again, this is due to a weaker US dollar acting as a strong tailwind for EM assets.

Conclusion

When looking at history, we note the following points:

- There is a clear inverse relationship between the US dollar and EM equities

- The US dollar has tended to strengthen going into rate hiking cycles and weaken in the months following the initiation of hikes

- Growth outlook differentials between EM and the US often act as indicators for peaks in US dollar strength; EM equities tend to outperform DM peers following US dollar peaks

If history serves as a guide, then we would anticipate USD strength to peak in the coming months, paving the way for EM outperformance versus DM as we move into 2023.

Malcolm Dorson, senior portfolio manager, Paul Dmitriev, senior investment analyst, and Trevor Yates, junior investment analyst, Mirae Asset Global Investments.