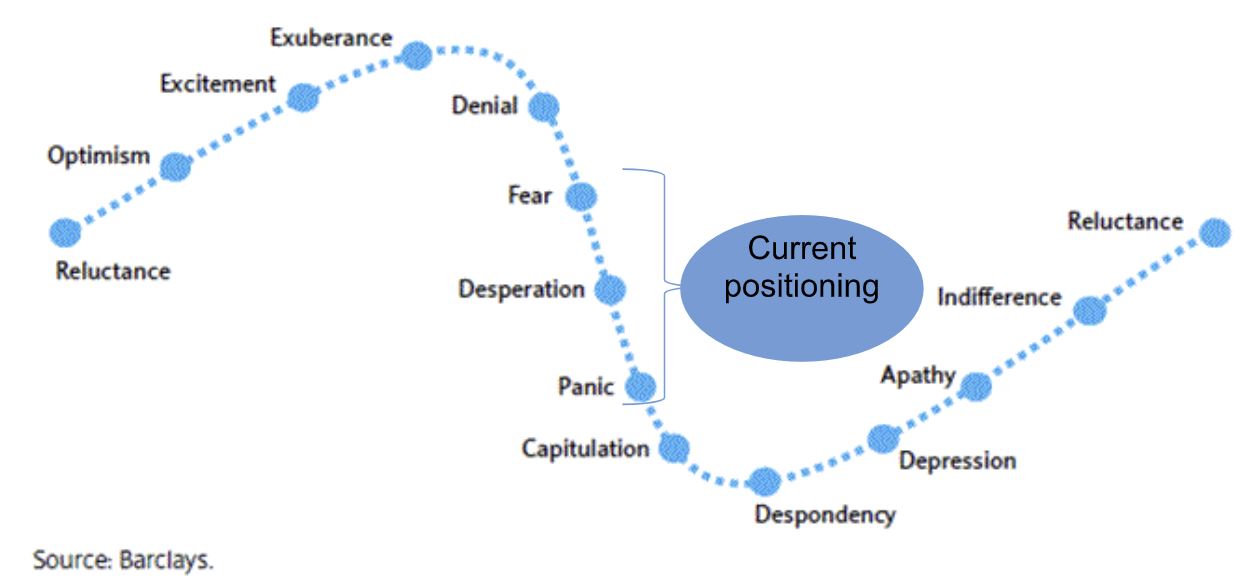

Sometimes, the biggest hurdle to overcome has less to do with the tangible financial or economic issues in front of us, and more to do with investor sentiment — especially in a climate such as this where, for many, the natural tendency is to pull back. What past cycles have shown us is that this is generally the wrong reaction. When others are leaning out, is precisely the time one should look for the right way to lean into certain areas. Otherwise, you run the risk of mistiming the market opportunity and possibly missing out on the return benefit as things recover.

Investor sentiment lifecycle

It doesn’t mean there aren’t risks. The changing tide for investors means there will be more of a thematic and ‘deal-pickers’ market going forward. In other words, strategy, sector, geography and manager selection criteria will be even greater determinants of how portfolios perform relative to their collective impact over the past 13 years given a ‘rising tide’ for most asset classes.

Reality check

Returns across all asset classes will likely be lower going forward. It is a near statistical certainty. However, keep in mind that if we lined up and ranked the average private equity net returns over the last 30 years, four of the last five vintage years would be ranked number one, two, three and four in that order. So, the average private equity returns, which had been hovering in the 25 per cent to 40 per cent net internal rate of return (IRR) range over the past five vintage years, may revert to more ‘pedestrian’ levels in line with longer-term averages. So net private equity returns on newly invested capital over the next 5 to 10 years is still expected to generate performance in the mid-to-high teens range, and the data supports this.

How will that performance stack up to other asset classes, including the public equity markets? While absolute levels of returns may come down, the relative outperformance of private market average returns is actually better when public returns are lower. The outperformance gap that private markets have generated historically over public market equivalents tends to be higher when the public market returns (x-axis) are lower. It’s in these types of market conditions where the private market strategies have the potential to outperform the most.

Why does private equity tend to outperform during choppy markets? Company quality could certainly be a factor, though that is difficult to measure systematically. In some cases, GPs marking assets to market are already conservative, and companies may have been on the books at lower valuations than traded comps (remember that GPs tend to exit their companies at a premium to holding value). There are also structural mechanisms that allow GPs to support their companies during times of stress that public companies don't have access to (for example calling more capital from their LPs and better access to capital markets) that may justify higher valuations. And some would argue that the price for a highly negotiated, majority stake transaction between a small number of parties should not necessarily be the same as the price for instant liquidity of a small minority position.

The challenge for investors, and what makes periods like this so difficult, is that we are still in a climate ripe with uncertainties and many of these — geopolitical risks, magnitude of rate rises, timing of valuation pivots, and the lingering impact of COVID — are not going away anytime soon.

For the financial markets, arguably the biggest focal point continues to be on the impact of inflation/rising interest rates on asset prices and a potential recession looming on the horizon. First, one must acknowledge that the macroeconomic environment in Europe is meaningfully different than in other developed markets given first-order impacts from Ukraine. However, the US and the Fed will likely be primary drivers of policy and approach toward tackling inflation.

Past peak inflation?

It is also worth keeping in mind that inflation is a lagging indicator. We have yet to see the full impact of monetary policy actions undertaken earlier this year. Commodity prices, mortgage applications and the like have already shown signs of retreating modestly in recent weeks. At the same time, other factors related to supply-driven disruptions — including inventory levels, container/freight shipping rates, transportation issues and a reopening of China — are similarly showing some early signs of easing.

According to a recent Fed paper on inflation, supply-related issues currently account for more than half of the record inflation levels experienced through Q2. These areas also tend to be less ‘sticky’ relative to factors like wage pressure, and so could also unwind more quickly. A reversal of this trend combined with a general slowdown on the demand side would point to more moderated inflation in the near term. The argument could be made that peak inflation is now behind us and that actions to tighten are already starting to have the desired effect.

Fundamentals versus valuation issues

Generally speaking, corporate business fundamentals — including earnings growth, margins and free cash flow — are also currently at historical highs. More broadly, private companies have continued to produce financial performance outpacing the growth of the public markets. This is not to say some of these fundamentals will not slow down. In many cases, it will be quite the opposite, which is exactly what the Fed and others are hoping for. As an example, balance sheets (for both businesses and the consumer) are in a good spot within the historical context. In other words, businesses today have a better starting point and more cushion to weather a pending economic storm.

Furthermore, the data shows that despite a persistent environment of rising valuation multiples over the past decade, private equity transactions were still purchased, on average, at a discount to public market comparable multiples.

These two factors — strong relative earnings growth and discounted initial purchase price multiples — likely account for at least some of the ‘lag’ typically seen in valuation movements within private market portfolios through Q1 and potentially for Q2. On the latter point, early indications from GPs are that most private market portfolios are likely to be flat as of 30 June 2022, but with notable differences across strategies (for example real estate portfolios will behave differently than buyout funds).

However, historical data would indicate that GPs’ directional guidance about Q2 2022 valuations may be somewhat optimistic. We’ve studied how private markets valuations tend to change given movements in relevant public market indices, and our data would suggest that private equity strategies tend to have betas close to 0.4 relative to those indices. With listed equities trading down substantially in Q2 — the S&P 500 lost just over 16 per cent of its value — the data would suggest most LP private equity portfolios to experience markdowns closer to 5 per cent.

Peak-to-trough and trough-to-peak performance

But what about a potential recession? The markets are currently pricing in a high probability of a recession in the US sometime in mid-2023 and even sooner in Europe. Safe haven assets, like Treasuries, have historically preserved value better than riskier assets during choppy market conditions. But timing the market is a risky and short-term game. The challenge is that being off by a few quarters or mistiming the peak or trough can lead to less-than-optimal, long-term returns compared to simply staying invested. This challenge is amplified for investments in private markets, where the rebalancing mechanisms are fewer and the lag time to restart a paused program can be significant. Also, and at the risk of stating the obvious, the shape, magnitude and duration of any potential recession will matter a great deal in terms of navigating the environment and ultimate outcomes.

Private markets generally lag public market downturns by two quarters, and as the data illustrates, tend to exhibit less observed volatility through the cycle. In other words, the peak-to-trough performance is not as low for private equity strategies. The longer-term recovery wave from trough-to-peak also shows that private equity outperforms the public side. Also notable is the duration of the downturn and recovery periods, with the former typically characterised by a shorter-time horizon of 1.5 to 2.5 years to experience the depth of the decline. Public markets generally recover more sharply, but longer-term performance back through the peak of the recovery period also favours private equity.

History never repeats, but it does often rhyme…

In our view, the current market dynamics will be similar to the 2000s tech reset, rather than the GFC. Here are a few reasons why:

- Similarities to 2000 - excess capital; innovation via tech enablement; fear of missing out important deals; paper gains; too many companies chasing the same market; a huge public market appetite for growth at any cost, defined by a valuation correction; and heightened geopolitical risks characterised by major military events

- Differences from 2000 - more capital in various private market strategies and stronger business fundamentals such as revenue, earnings, margins, transactions in high-quality businesses with long-term reasons to exist (relative to dot-com era companies)

- Why not GFC 2.0? There is no broader financial market stability issue such as the a financial crisis and debt default-driven cycle in 2007, and there are better corporate and consumer balance sheets today

Conclusion

It is more likely than not that we are headed for a moderate downturn. Rather, performance from here is likely to be driven by more specific and tactical investment considerations. The industry, geography and strategy profile will more meaningfully dictate delineation of returns as the tide goes out. The tried-and-true method of staying invested and not timing the market will also likely be the better longer-term path for most investors.

Drew Schardt, global co-head of investments; Bryan Jenkins, head of private market analytics, Hamilton Lane