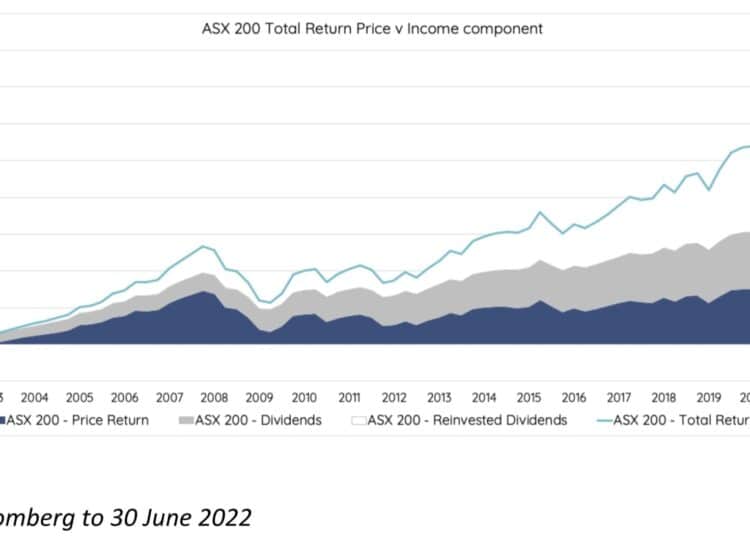

Over the last 20 years, the portion of ASX 200 total return from income has outweighed that from capital growth (See chart below).

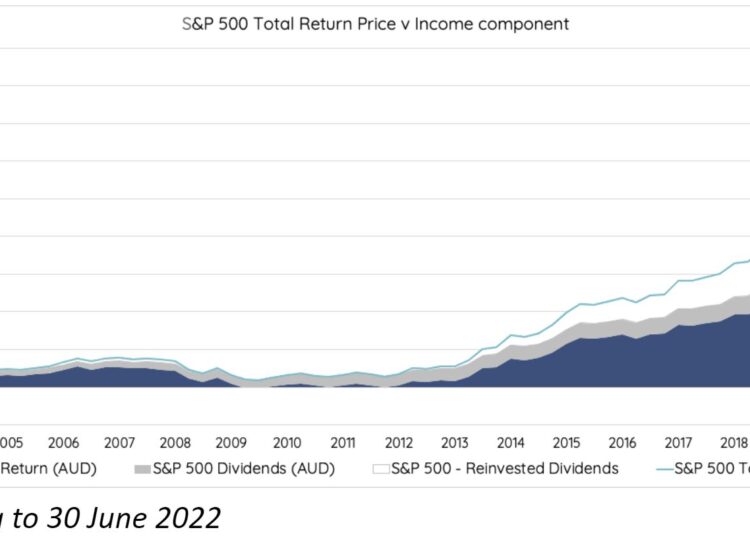

Over the same period, the story overseas is that dividends have often made a material difference but not to the same extent as in Australia (See chart below).

After an exceptionally strong period for capital growth, domestic and overseas investors ought to be looking for more income from their international equities. In the 150 years since the inception of the S&P 500, the returns from capital growth and income are almost 50:50 whereas in three of the last four decades, capital growth has made up most of the total. Capital growth is due to take a back seat.

The demand for income happens to suit our process because our risk-reducing use of options generates a consistent income stream that exists away from the business cycle and actually benefits from market downturns. Perhaps because we have this additional source of income, we are conscious of the risks associated with dividends. Make no mistake, we like dividends, but they are not an income cure-all.

Events during the pandemic are only the most recent reminders that companies can cut their dividends in the face of cyclical weakness, especially if an uncertain outlook accompanies the downturn. From a business perspective, cutting is often the prudent thing to do but it means investors can see their income stream fall just when they most need the money.

The pandemic was also a reminder that authorities can take the dividend decision out of management’s hands by mandating dividend cuts. For example, if central banks and governments anticipate systemic problems, they will not hesitate to stop anything that raises the risk of undercapitalisation, especially in the financial sector.

Another risk of over-reliance on dividends is that yield hunters can find themselves crowding into certain regions like Australia and the UK, and into certain sectors like banks, insurers, resources, and tobacco. This is not to say that there is anything wrong with these in principle, although for ESG reasons, Talaria does not invest in tobacco stocks, but overexposure to any area of the market is contrary to the diversification that is fundamental to portfolio construction.

For returns from financial assets, the period from the GFC low to the end of last year was golden. However, the long-run outlook is far less attractive, which means every cent counts and income is likely to more than play its part. Dividends are therefore going to be an important part of the answer, but investors should have their eyes open when dividend yield hunting. They should also consider other sources of income, such as option premium, that exist away from corporate cash flows.

Hugh Selby-Smith, co-chief investment officer, Talaria Capital