Investors in global equities particularly saw growth stocks take a beating, as the realisation dawned that historically, low interest rates had masked some excesses and revealed that the underlying earnings to support any excess was absent, especially in many new technology companies.

In such a volatile and perilous investment environment, sticking to your fundamentals is crucial. But it is not always easy, especially when negative headlines dominate day after day.

For investors in global equities, the fundamental tenet of buying companies whose returns are going to be generated by superior growth over time still makes sense for long-term investors.

Indeed, many well-known growth companies have been repriced to account for a more expensive cost of capital. This is why, when looking ahead, proven earnings growth is likely to be a bigger driver of returns.

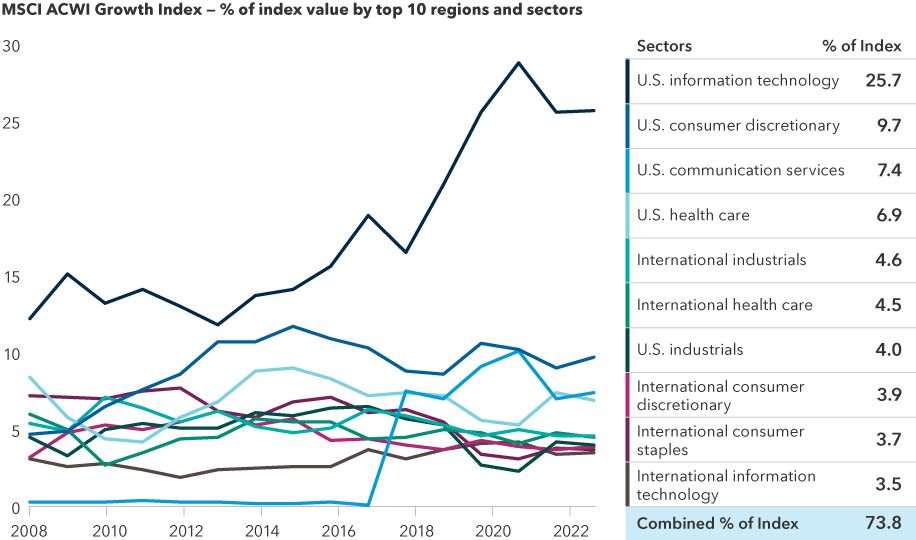

And the good news is that companies with this type of revenue and growth potential will probably come from a broader range of industries and regions in the future — not just tech and consumer stocks.

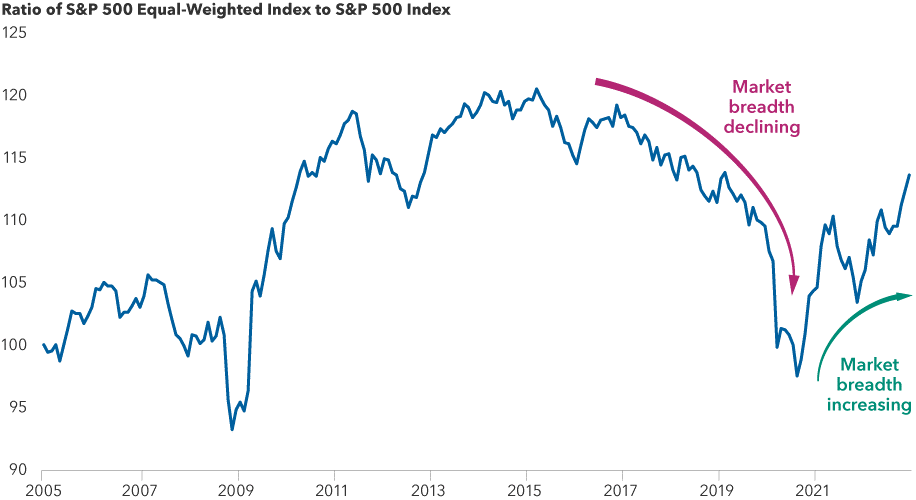

Markets are moving from narrow to broader leadership

Data as at 31 December 2022, indexed to 100 as of 1 January 2005. Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s

In a sense, global equity investors are today moving from what had been a very binary world — investing in one sector (like tech) and investing primarily in the US — to a more balanced and diverse investment environment that perhaps has a broader sense of opportunity.

The crucial question for growth-oriented investors now is: Where to from here?

The AI inflection point is here

Tech and consumer stocks have been punished in recent times and in some cases, that has perhaps been warranted. But in other cases, good growth companies with long-term revenue generating prospects have been caught up in the “correction”. As such, there is a risk that the market may be overlooking strong fundamentals in some well-positioned companies.

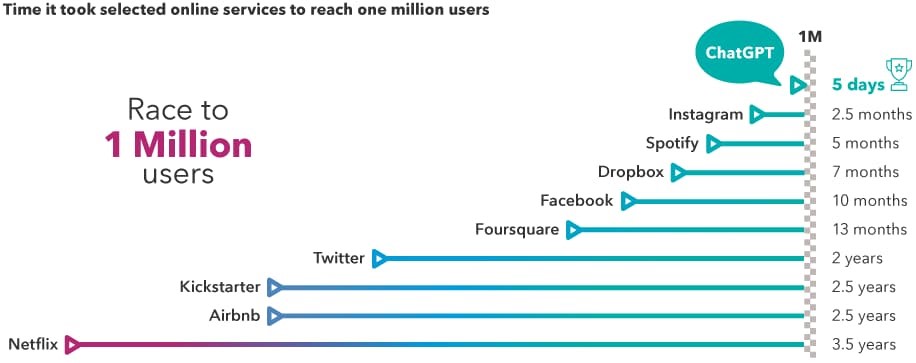

What’s more, the pace of innovation around the world is picking up and there is a solid argument that we may be at an inflection point with artificial intelligence (AI).

The speed of adoption for new technologies is picking up

Data as at 31 December 2022. Kickstarter refers to number of backers. Airbnb refers to number of nights booked. Foursquare and Instagram refer to number of downloads. Source: Statista

Companies like Microsoft are using AI technology to help differentiate their product and service offerings and deliver enhanced productivity to customers. Microsoft has already issued a limited test release of its Bing search engine that harnesses ChatGPT, a chatbot developed in partnership with OpenAI. Microsoft has also disclosed plans to include the technology in its widely used Office software suite, its Teams platform, and its GitHub code-development service.

Wider adoption of AI technology will require massive computing power, which represents strong tailwinds for cloud services and the semiconductor industry. Nvidia, which develops semiconductors and computing hardware, already uses AI to improve the speed of its own product development and recently disclosed an AI distribution partnership with Microsoft. Semiconductor maker Broadcom, which helped develop AI chips for Google in 2016, has since introduced more advanced AI chips.

The AI landscape is evolving and evolving fast, and we are very early in the development of this technology. In many senses, it resembles the early days of mobile and cloud as those technology breakthroughs entered an era of hyper-charged growth. Regardless, the long-term investment opportunities on this horizon remain intact.

‘Picks and shovels’ enable growth across industries

One of the lessons that Capital Group has learned over many years and many cycles as a long-term investor is to closely track capital floods and droughts.

When capital floods into a sector, it usually drives increased investment that can lead to opportunities for suppliers in that industry. Colloquially, you could think of these as “pick-and-shovel” companies.

Investors sometimes overlook these businesses, but they often have more stable cash flows and lower risk profiles compared to the “capital-flood” companies they are servicing.

For example, consider how much money has flowed into healthcare research and development (R&D). This has been happening for a few years, but the trend really turbocharged during the pandemic. Pharmaceutical companies that successfully developed COVID-19 vaccines and anti-viral treatments, such as Pfizer and Moderna, piled up cash. Much of this capital will be funnelled into more R&D.

Pick-and-shovel companies like Danaher and Thermo Fisher Scientific, which provide drugmakers with testing equipment, reagents, and diagnostics, could see demand for their services rise as R&D investment grows.

By contrast, in the energy sector, we saw a years-long capital drought as energy prices touched levels near zero. Then, as soon as energy supplies got tight and prices rose, capital flooded back in. Record-breaking cash flow over the last 12 months has left oil producers with some of the strongest balance sheets in history.

Even though energy is not a growth sector, there are opportunities for growth within it. When energy companies profit, they typically expand exploration and production, which requires more machinery and services. This could be a source of growth for companies that provide technology, products, and services to the industry.

Tech and consumer sectors aren’t the only sources of growth potential

Values through 2023 are current as of 31 January 2023. Sources: Capital Group, MSCI, Refinitiv Datastream

Global champions get stronger as the dollar weakens

For companies outside the US, the US dollar strength tends to be a headwind. At some point, the Federal Reserve will have to cut rates and when that happens, we may see further US dollar weakness. And regardless of whether economies in Europe or Asia do well, there will be great companies in those regions with solid business prospects.

Today, there are select companies outside the US that have been waking up to their opportunity globally. They are refocusing on generating value for shareholders during a time that is much more beneficial for their currency. In other words, like basketball, the world is catching up.

Consider ASML, the world’s leading provider of manufacturing equipment for the most advanced semiconductors. It just happens to be based in the Netherlands. ASML has developed unique technology for making advanced chips. As its market share grew, it aggressively invested in developing its technological advantage. Right now, many chip stocks are down and the industry is struggling with oversupply. But taking a multi-year view, the industry is well positioned for a strong cyclical recovery.

Another example is in drug discovery. We are in the middle of a golden age of healthcare innovation. Many of the recent advances in treatments for cancer and pathogens like the COVID-19 virus have been developed by US companies. But there is also a Danish pharmaceutical company, Novo Nordisk, that has developed therapies to treat diabetes and obesity. Again, interest in this company has less to do with whether European markets can outpace US markets and more to do with a worldwide increase in diabetes and obesity and the potential to improve patients’ lives.

Patience and persistence remain a virtue

If there is one lesson that time has taught investors again and again, it is that the key to navigating volatile markets is patience and persistence.

Understandably, there are today a lot of questions about the impact of inflation, prospects for recession, and weakness in parts of the banking sector.

But there are always opportunities ahead. Growth investing is down but not out. Seeking to invest in companies with superior long-term prospects is as relevant today as it ever has been, and such companies are more likely to survive market downturns and come out stronger on the other side.

Matt Reynolds, investment director, Capital Group (Australia)