Australian investors should consider how foreign currency movements might impact their total returns.

“If inflation-adjusted interest rates decline in a given country, its currency is likely to decline.”

– Ray Dalio, founder and co-chief investment officer, Bridgewater Associates

What has the Australian dollar done for your global equity returns lately?

Global share markets have performed well over much of the last three years, excluding the pull-back last year as interest rate expectations increased. The major international economies are now expected to avoid a significant recession as interest rates peak. This is expected to support equity returns over the medium-term, although we may see some near-term volatility.

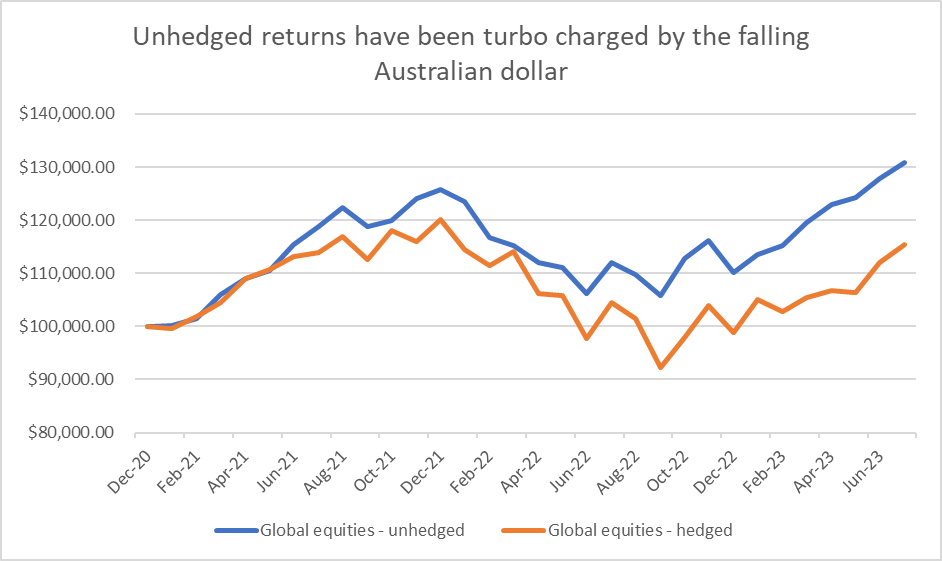

Aussie investors with unhedged positions in global share markets have seen returns further boosted by a period of Australian dollar (AUD) weakness since early 2021:

Source: Bloomberg

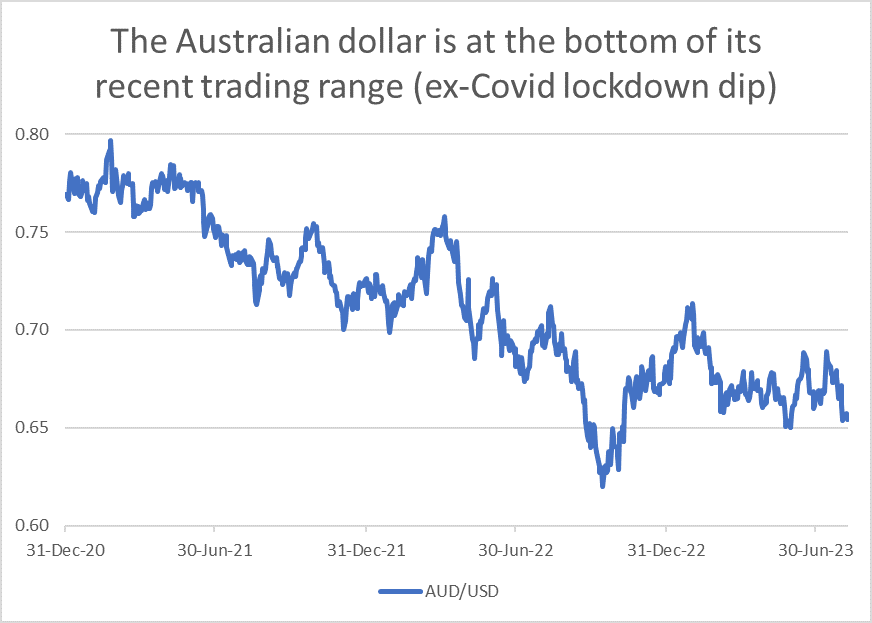

This partly reflects US dollar (USD) strength, which is regarded by many global investors as a safe haven during periods of uncertainty. Furthermore, the US began raising interest rates before Australia did and then progressed along this path more aggressively. Higher cash rates and shorter-term bond yields in the US have helped support the USD relative to the AUD:

Source: Bloomberg

The value of the AUD is also closely linked to the price of Australia’s key commodity exports, which have fallen over recent quarters. This reflects the easing of Europe’s energy crisis, lower demand for iron-ore as China’s economy pivots away from infrastructure, property and industrial investment towards consumption and bumper wheat harvests.

Will we see a stronger Australian dollar?

Australia’s currency is pro-cyclical, which simply means it tends to appreciate when the global economy is expanding, and to fall during a downturn. The AUD is expected to strengthen as the level of risk aversion in the global economy diminishes and animal spirits return to investment markets.

The US appears to be bringing inflation under control faster than other economies including Australia. When this allows US interest rates to fall, it will reduce the interest rate differential with Australia, which in theory, should push down the value of the USD relative to the AUD.

China’s government has indicated that it will take measures to stimulate its economy and has moderated its hostility towards its real estate sector. The timing and size of any reflation package are unclear. However, potential measures include aiding the property market and subsidising locally made electric vehicles, which would boost the demand for industrial commodities, especially iron-ore, supporting the AUD.

Recovery in the global economy will also likely support energy and agricultural commodity prices, further boosting Australia’s trade balance and supporting the currency.

The return to global travel is bringing an influx of migrants to Australia, both high-skilled and those on working holidays. This will support nominal economic growth, which tends to increase demand for the currency over the longer-term.

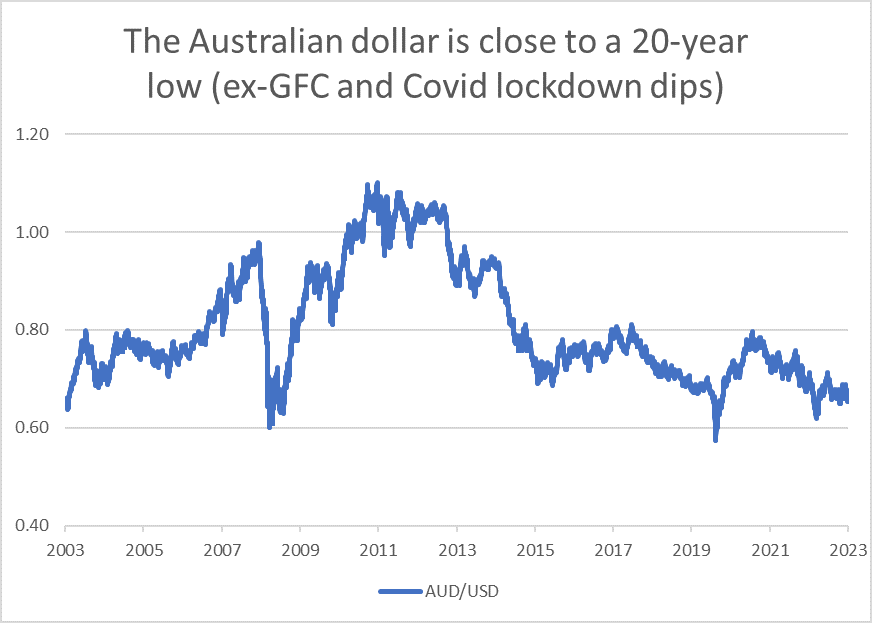

Moreover, looking back over a 20-year period, the currency now appears relatively inexpensively valued when viewed on an historic basis:

Source: Bloomberg

What might Australian investors consider?

The future path of exchange rates is always impossible to forecast over the short-term with any level of confidence. However, investors should recognise that any strengthening in the value of the Australian dollar can be expected to impact their returns from investing in global equity markets.

Exchange rate movements will depend upon changes to relative inflation rates, relative interest rates, relative GDP growth rates, and commodity prices. These obviously are unknown in advance. However, it is easy to see how the AUD might appreciate over the coming quarters, given its current weakness relative to historic norms.

This is not an argument to divest from global equities. Gaining exposure to a diversified portfolio of high-growth innovative sectors such as technology, pharmaceuticals, industrials, and luxury goods is much harder to achieve if an investor is confined to Australia’s 2 per cent share of the global equity market.

Nonetheless, reducing exposure to foreign exchange risk might be appropriate for some investors at certain times. Large institutional investors manage this risk through hedging strategies using derivative instruments. However, this is generally impractical for most retail investors.

In practice, retail investors can most efficiently manage the currency risk of their global share market exposure by investing in a managed hedged international equity fund. This leaves the investor exposed to the growth of the global share market but protected from any appreciation of the AUD that could diminish their total returns.

Tim Richardson CFA, investment specialist, Pengana Capital Group