This might involve the responsible allocation, management, and oversight of capital to create long-term value while providing sustainable benefits for the economy, the environment, and society.

Investment approaches can be adapted to accommodate either financial or non-financial goals, or to apply elements of both. Quality in investment management comes down to whether a manager has expertise in markets, offers transparency to confirm it is investing in line with a client’s expectations and, with the client’s financial goal in mind, understands how different risks might affect the value of investments.

Environmental, social and governance (ESG) issues can be important drivers of investment risk. For example, environmental risks – such as natural disasters, weather patterns, and climate change – can have a significant effect on a company or a country’s economic and political outlook. In Australia, for example, the national emissions target for 2030 will require a rapid increase in renewable energy capacity. A key hurdle is that most of Australia’s existing large industrial sites are more than 20 years old, so costs of adaptation may be significant, and the risks of stranded assets may increase.

Social factors, such as local labour dynamics or demographic changes, can materially shift investors’ perceptions. Governance factors, ranging from the quality of institutional frameworks to respect for the rule of law, can materially influence investment performance.

Alongside a focus on the ESG factors that can affect investment value, some of our clients also wish to consider the impact of their portfolio on the wider world. They may be seeking to limit their negative impact – perhaps by avoiding investments in sectors such as tobacco. Others may wish to actively pursue a positive impact, perhaps by focusing on investments that help to fund environmentally friendly projects.

There has also been dramatic growth in the green and social bond markets, enabling investors to target both financial and non-financial goals through their investments. At Insight, we operate a well-established framework to assess these bonds to analyse whether such bonds meet certain standards.

When seeking to understand ESG risks, the approach needs to be adapted to the asset class because the impact of these risks can vary significantly depending on a wide range of factors. In fixed income, one of our priorities is to understand default risk in portfolios on behalf of our clients.

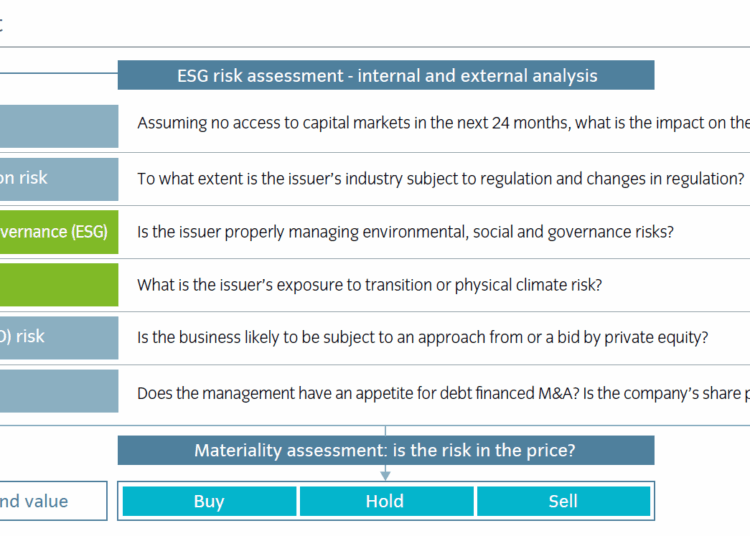

Our corporate credit investment process applies what we call a “landmine checklist”, looking for factors that might cause a sudden, unexpected deterioration in a bond issuer’s credit quality. The checklist includes ESG risks and climate risk.

Source: Responsible Stewardship at Insight: 2023 Report

To assist with our assessments, our analysts and portfolio managers can also apply Insight’s proprietary, risk-centric Prime ratings. These encompass ESG and climate risk ratings focused on corporate issuers and ESG risk and impact ratings for sovereign issuers.

Prime ratings can be used as a tool for considering material ESG risks, informing decision making and engagement, and enabling tailored portfolios for clients requesting specific sustainability criteria. Insight developed Prime because ESG data providers often disagree and there are gaps in available information.

Our analysis may also prompt us to engage with issuers to understand the risks. This engagement could be through direct dialogue, group meetings, collaborative initiatives and via our counterparties. We do this to ensure that we better understand the relevant risks that we have identified in respect of the issuer, including ESG risks. Where we engage with issuers, we may seek to influence them to improve their practices.

Exactly how we pursue this activity will depend on its relevance to the investment strategy and is subject to the terms of our mandate with the underlying client.

In some portfolios, we focus on specific themes such as:

- Climate change – one of the greatest challenges of our time. Governments and businesses are grappling with its implications and the increasing urgency by which emissions need to be reduced. As a response to the global risks posed by climate change, Insight became a signatory of the Net Zero Asset Managers initiative, where we committed to set an interim target for the proportion of assets to be managed in line with the attainment of net-zero emissions by 2050 or sooner.

- Water management – the UN estimated that there will be a 40 per cent shortfall of the available global water supply by 2030. Recent research has also highlighted the significance of the financial impacts of water risks, which are much greater than the costs of addressing them. Many businesses and their supply chains rely on withdrawing fresh water in water scarce areas and water scarcity can significantly increase the risk of business interruption. Water risks are also exacerbated by climate change. Our analysis evaluates water stewardship disclosures and performance and aims to support engagement with issuers that we view are misaligned with our expectations for prudent water risk management.

- Diversity and inclusion – this is a topic of increasing importance across both social and governance themes. There is an increasing body of research to support improving diversity and inclusion at companies, which has shown that a company’s practices can have a financially material impact through performance and productivity, employee recruitment and retention, and litigation.

Bruce Murphy, director, Australia and New Zealand, Insight Investment