Within this opportunity set, green bonds – with their average AA-credit rating – are well-suited to satisfy investors’ requirements in this uncertain macro environment, while further supporting the green transition and enabling credible environmental projects.

A sustainable port

Central banks took a firm stance over June to August, pressing forward several rate hikes, highlighting that further decisions will be fully data-dependent. However, as economic data shows some signs of contraction and inflation is slowing, central banks seem closer to peak rates. Rates are likely to remain high for some time, offering attractive entry points, particularly from a yield perspective for fixed income investors.

The sustainable bond market is no exception, with investors able to access similar yields as conventional bonds. Where it differs, of course, is in the higher transparency these bonds offer, be that in the projects they are financing or in the ability they offer to measure the environmental benefit of the investment. This explains why this segment is so popular, at a time when the financing requirements for the transition to a low-carbon economy have never been greater.

Issuers’ growing appetite for green bonds

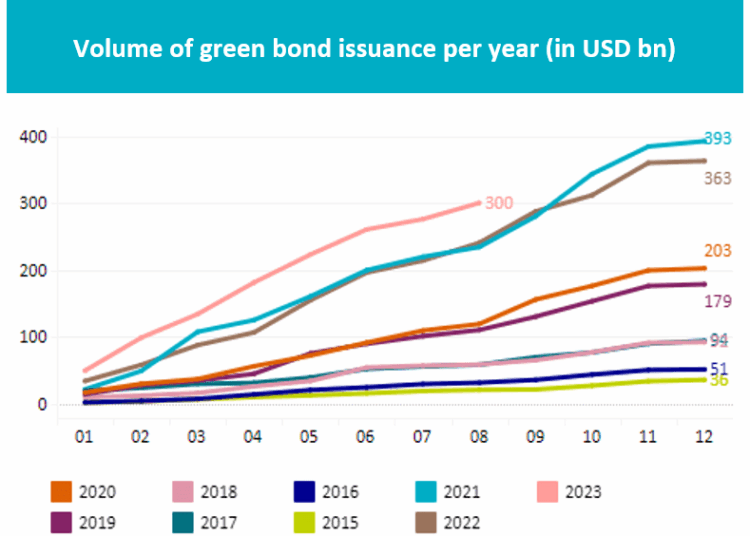

While issuances of social and sustainability bonds are growing, green bonds continue to be the most active segment of the market and have seen record high issuance so far in 2023. At the end of August, the green bond market represented almost $1,400 billion, with more than 700 distinct issuers, including corporates, banks and sovereigns. Over 2023 alone, more than $300 billion of issuances were for green bonds and made by 69 new issuers at this stage.

These new issuers, who are adopting the green bond format to finance their transition efforts, have been key. The universe benefited from increased diversification through private debt, with a strong proportion from real estate, telecommunications and the automotive sector, while sovereign debt saw a host of new issuing countries.

Source: AXA IM, Bloomberg as at 31 August 2023 (Green bond market ex CNY, excl. outstanding <$300mio). For illustrative purpose only.

Unlocking new opportunities

The continued strong demand for green financing has enabled the green bond market to grow into a relatively developed market that can offer investors a credible alternative with diversification and high credit quality.

How green bonds are issued, as well as government’s incentives to corporations, are also evolving as this market becomes more mature. In Japan, the Green Transformation (GX) policy aims to reduce carbon emissions and boost the economy through creating demand in the stable energy supply and decarbonisation space. This has led to the improved competitiveness of its industries and economic growth, with ¥150 trillion of public investments targeted over the next 10 years. The European Union and the US have previously announced similar measures, such as the NextGenerationEU program and the Inflation Reduction Act respectively. These initiatives give grounds for optimism about the future of the green bond market and the opportunities it should offer.

Within developed countries, euro issuance continues to dominate the green bond market, making up 65 per cent of issuance. This reflects Europe’s leadership in the fight against climate change and in the development of green bonds. The EU is thus proposing a very ambitious strategy to combat climate change, defining standards for corporates as well as investors. With its green taxonomy, aimed at defining environmentally sustainable activities, and the introduction of EU green bond standard, the region is seeking to ensure credible growth in investment in the transition to a low-carbon economy, making green bonds an essential instrument.

Thailand is another example of a country taking innovative steps to get the most of out of green bond issuances – the country issued its very first green bond principles, creating a healthy ecosystem for green bond issuers and investors.

Emerging market and Asian countries offering green bonds currently only make up 9 per cent of the market. However, we believe it is encouraging to see the growing attention and willingness from some regulatory bodies to create more comprehensible and adapted guidance for the sustainable bond market.

An attractive entry point

This rapid growth in green bonds is good news for investors seeking sustainable fixed income assets both in terms of portfolio diversification and project financing and refinancing.

We remain confident in the green bond market and its active development against the backdrop of attractive valuations, competitive yield and the long-term benefits of a well-balanced universe and transparency.

With interest rates still at historically high levels and current bonds at an average duration of six-and-a-half years, we believe this is an attractive entry point for fixed income investors looking to help drive meaningful environmental progress.

Johann Ple, green, social and sustainability bonds strategy manager, AXA IM