We see four key reasons why embracing the global credit opportunity set is an attractive alternative.

- Extra diversification but remaining investment grade – more sectors, more issuers, more issues, more opportunities.

- A stronger credit profile – including top rated, AAA assets can improve the security of your portfolio in times of stress.

- Credit offers an attractive yield to investors, just as corporates do.

- Over the long term, returns from global credit has typically beaten global corporates during periods of relative stability and modestly positive markets, and reinforced its defensive nature when returns were negative.

Additional avenues for capturing value and reducing risk provided by different issuers

The global corporate universe is large, around US$12 trillion in size, and includes more than 2,800 issuers from around the world. Though that certainly allows for extensive diversification and spreading of risk, it is still confined to the three main corporate sectors of industrials (which dominate in terms of size and number), financials, and utilities. All of those are exposed to the risks associated with the economic cycle and what that can mean for corporate profitability.

Global credit is larger still, at more than US$15.8 trillion, and it is even more diverse. It builds on all those corporates and adds an array of 600+ other issuers. Those include supranationals such as the Asian Development Bank, as well as other local authority and agency issues. While some of those may appear to be a corporate and trade like a corporate, they don’t fall into the corporate index simply because there is an element of government ownership. Examples include EDF and Air New Zealand. Global credit also includes a number of governments borrowing in currencies not their own. A key characteristic of global credit is that it remains completely investment grade and contrary to some beliefs, does not contain any securitised instruments or treasuries.

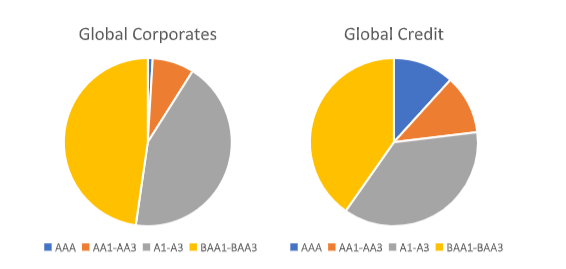

Boost the overall credit profile

These additional issuers typically have a better credit rating profile than pure corporates. Of the 29 supranational bodies in the index, 15 are rated AAA and more than 99 per cent of supranational issuance and almost 68 per cent of all issuance beyond the pure corporate is rated AA3 (AA-) or better. By contrast, just 9 per cent of all the corporates index is rated that highly. The credit rating profile for global credit is stronger than for global corporates, as Figure 1 shows.

Having some form of direct government backing or guarantee typically helps underpin the credit rating of these additional issuers. That makes them less susceptible to downturns in the economic cycle.

Attractive yield on credit, no need to compromise on spread

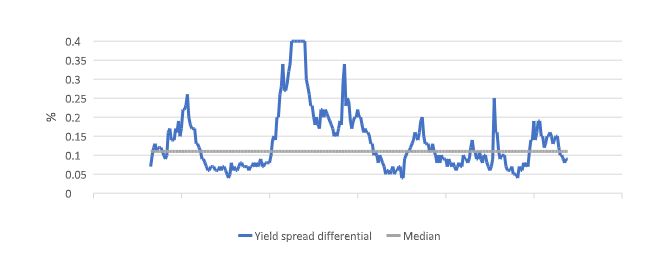

Both global corporates and global credit currently have attractive levels of overall yield and because the global corporate universe has a lower credit rating, it makes sense it has a slightly higher yield. But the extra spread it has over credit is not as high as it has frequently been in the past.

At the end of May 2024, the yield was 5.10 per cent for global corporates compared to 4.96 per cent for global credit, a gap of just 0.14 per cent. Each is well within the highest quarter of observations seen since 2000.

However, if you look at the difference in the yield spread over government bonds for each, the excess spread offered by global corporates (0.95 per cent) over governments compared to the excess offered by global credit (0.86 per cent), the gap has been eroded substantially since they peaked in 2022. It now looks more favourable for global credit. At the end of May 2024, the 0.09 per cent gap was close to the bottom of the long-term range and not far above the lowest level (0.04 per cent) seen since 2000.

Figure 2: Spread premium offered by global corporates over global credit is close to its lowest levels

More attractive long-term risk-return dynamics for global credit

Returns over the long term have been broadly similar for both universes, perhaps not surprising given the extensive overlap between them. From September 2000 to May 2024, global credit has delivered a higher Sharpe ratio than global corporates. The Sharpe ratio measures the risk-adjusted excess returns of an index or portfolio and allows investors to compare historic outcomes of similar strategies or approaches.

Global credit exhibited some attractive defensive qualities. Reinforcing its more defensive nature, in the six calendar years when returns were negative, global credit outperformed on four occasions, with an average better return of 0.31 per cent in those years.

Global credit has also done relatively well during steadier periods when returns have been modestly positive. In four of the seven years when returns were between 0–8 per cent, global credit beat global corporate markets.

Not only has global credit stood up well in most market environments, diversifying to include non-corporates changes the risk profile. Risk aware investors may be interested to know that the monthly standard deviation of historic returns for global credit is lower than it is for global corporates.

Global credit – offering a little more

Rather than settling for a simple corporate portfolio for their non-Treasury bond investments, investors may wish to look a little beyond that and consider the credit universe for their strategy. We believe the benefits make it more than worthwhile.

Adam Whiteley, head of global credit, Insight Investment