A primary driver has been uncertainty surrounding the degree to which the Trump administration’s aggressive trade rhetoric will ultimately be enforced. Not to be overlooked is the largely unrelated sell-off in the so-called Magnificent 7 mega-cap stocks, which was driven mostly by multiple compression after a considerable run-up.

While the current episode is both elevated and unwelcome, volatility is a reality that equities investors must endure.

Uncertainty around tariffs and supply chains and any knock-on effects to inflation, employment and economic growth will invariably impact corporate earnings. Given the temperature of the rhetoric – and equally heated responses by targeted countries – we suspect that the endgame could fall short of the most extreme proposals.

While any reconfiguration of well-established regional and global supply chains will come at a cost, with inputs and capital not necessarily flowing to their most efficient source of production, once the new playing field is established, corporations can invest within this framework.

Such transitions – even those with minimal economic impact – may create opportunities for investors to provide capital to corporations as they adjust their operations. In many respects, the current re-examination of trade among developed markets is a continuation of the post-pandemic trend of backing away from peak globalisation.

Perspective

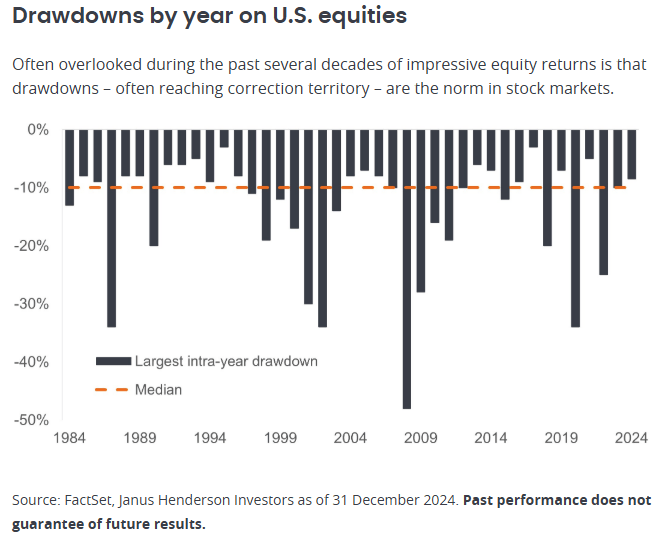

For much of the past week, the S&P 500 Index has been flirting with correction territory (defined as a 10 per cent dip from its recent peak). The tech-heavy Nasdaq is already there, due to the artificial intelligence (AI) trade blowing off some steam.

Corrections are not uncommon. In fact, over the past 40 years, 18 years have seen a drop of at least 10 per cent. Even when dealing with fierce crises such as the Global Financial Crisis and the COVID-19 pandemic, equity markets have tended to rebound. Since 2000, after the S&P 500 experienced a 10 per cent correction, its average total return for the following three-year period was 35 per cent – as shown below.

What we’re watching

Understandably, automobile and appliance manufacturers have registered some of the year’s steepest sell-offs, given their reliance upon steel and aluminium. It is too early to state with confidence how future trade policy will impact companies within these sectors. While ambiguity may cloud their outlook, other potential headwinds in markets and the economy merit close observation.

While aggregate S&P 500 earnings estimates for 2025 are only modestly off their peak, some cyclically sensitive components – e.g., airlines – have seen downward earnings revisions.

On the economic front, the Federal Reserve Bank of Atlanta’s GDPNow estimate of the current quarter’s economic growth has precipitously declined.

Cyclical v secular

The US economy has proven more resilient than its developed market peers. Consensus at the start of the year was that the cycle could plausibly be extended given anticipation of a pro-business agenda of deregulation and tax reform. Those policies have – for now – taken a back seat to trade.

It’s up to markets to balance the costs and benefits of these policies with what they mean for the corporate sector. We expect light to be shed on these questions as parties negotiate a resolution to the current trade impasse and clarity emerges around how the Trump administration approaches regulation and taxes.

Many investors tend to overreact to volatility, materially decreasing their exposure to risk assets. Over the long term, that can be a mistake. This is especially true today as the US and global economy are on the precipice of an AI-driven productivity revolution – a theme that just got considerably cheaper to access.

Should the US cycle finally turn, we’d expect defensive names, companies with resilient business models, and consistent dividend payers to hold their own.

Meanwhile, a fundamental shift in the international trade framework – should it come to that – could force Europe to take steps to further liberalise its economy and unleash their long-dormant animal spirits. Germany’s recent election is a potential signal for that.

We, along with other market participants, will continue to monitor policy developments and their potential impact on the corporate sector.

Regardless of the outcome, opportunities for generating excess returns will again present themselves. This expectation could arguably be reinforced by diverging economic trajectories across the world. To identify these opportunities – along with durable secular themes – we believe investors should maintain a global mindset, rigorously analyse a range of scenarios, and stay invested.

Marc Pinto, head of Americas equities, and Seth Meyer, global head of client portfolio management, Janus Henderson Investors