In a statement released yesterday, S&P Dow Jones said growing importance of “carbon considerations” was driving its decision to publish the metrics, which utilises data from Trucost, on its website.

“The initiative is part of S&P DJI’s commitment to support ESG transparency enabling market participants to understand, measure and manage carbon risk,” the statement said.

S&P Dow Jones Indices senior director of strategy and ESG indices Hannah Skeates said carbon metrics were “likely to become commonplace”.

“Once market participants understand their carbon exposure, they can begin to find solutions to manage this exposure and potential risk,” Ms Skeates said.

“Whether reducing carbon exposure through a broad market low carbon strategy, or via fossil fuel divestment, S&P Dow Jones Indices has indices – and the carbon metrics to measure it.”

According to the statement, the three carbon metrics published on the website are:

- Carbon Footprint – metric tons of CO2e (carbon dioxide equivalent) per US$1 million invested against the index;

- Carbon Efficiency – metric tons of CO2e per US$1 million of a company’s revenues against the index; and

- Fossil Fuel Reserve Emissions – the greenhouse gas emissions that could be generated if the proven and probable fossil fuel reserves owned by constituents were burned per US$1 million invested.

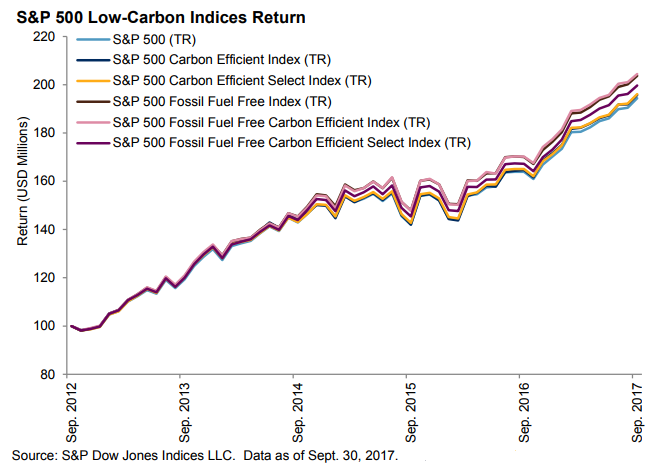

In comparing the returns of six versions of the S&P 500 Index in a report titled Stepping Up to Carbon Transparency, S&P Dow Jones argued against the myth that low-carbon indexes delivered lower returns.

“The low-carbon versions of the S&P 500 actually outperformed the benchmark over the five-year period,” the report said.

In December last year, NAB Asset Servicing also launched a tool allowing clients to assess the carbon intensity of their investments.