Industry consolidation since 2007 means there are now half as many super funds in Australia, says Rice Warner – but the number of investment options has tripled to 41,000 (according to APRA statistics).

Considering that as many as 80 per cent of Australians do not exercise a choice when it comes to their super fund, 41,000 investment options appears to be far too many, says Rice Warner.

"Is there such a thing as too much choice? In superannuation, the answer is almost certainly yes," said Rice Warner in a new article titled How much choice is too much choice?

Rice Warner cited a June 2015 University of Pennsylvania Wharton School study that found excessive investment options costs members US$9,400 per year.

The consultant's own research found that a "staggering" 85 per cent of industry fund members do not make an investment choice and are placed in their fund's default option.

Of the remaining 15 per cent of industry fund members who do make a choice, the "clear majority" are invested in one of their fund's pre-mixed options, said Rice Warner.

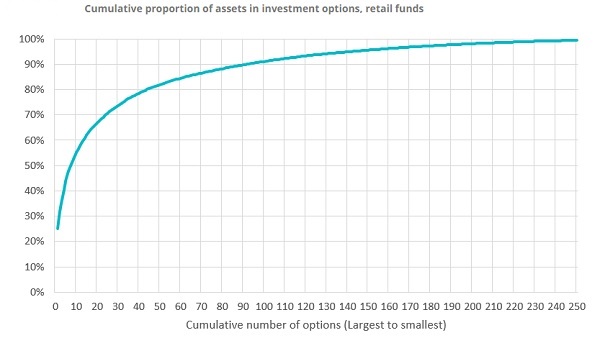

Even retail funds, where choice of fund and financial advice are far more prevalent, 30 of the options on offer across all funds account for 75 per cent of all investments, said Rice Warner (see graph below).

Source: Rice Warner

"Overall, this suggests that even in a high choice environment, members do not utilise the full suite of choices which are made available," said the consultant.

"To assist member decision making and avoid the paralysis that accompanies too much choice, perhaps funds should consider scaling back the number of options available."

In place of the 41,000 investment options currently available, Rice Warner suggested that a "revised" menu for super funds could include:

- a sensible default for all members more than five years from retirement;

- a tailored default for those transitioning into retirement or on pension;

- premixed options with suitable growth profiles (say five);

- a small set of sector-based options (say five); and

- niche options like socially responsible investments (SRI), indexed strategies or member direct investments (MDI) chosen to suit fund membership (recognising that the small take-up rates will require a cross-subsidy from other members).

"This smaller subset would allow members to customise their asset allocations or replicate strategies without overwhelming them with too many choices," said Rice Warner.

In the context of an industry focused on member engagement and a regulator aiming to shut down inefficient funds, it is timely for funds to rethink their investment strategies and to provide solutions (investment menus) that are better tailored to member needs and behaviours.